Close-up of arguably the most underrated industrial mineral: Fluorite aka Fluorspar

Disseminated on behalf of Commerce Resources Corp., Saville Resources Inc. and Zimtu Capital Corp.

Today, Saville Resources Inc. (TSX.V: SRE) highlighted the fluorspar potential of its niobium project, optioned from its neighbor Commerce Resources Corp. (TSX.V: CCE), which is busy developing its Ashram REE (Rare Earth Element) Project in Québec, Canada, following the recent closing of a +$2.5 million CAD financing.

Ashram is not only one of the world‘s largest REE deposits but is also one of the largest fluorspar (CaF2) deposits globally with defined mineral resources. Therefore, the Ashram Deposit is not only an advanced-stage REE deposit, which remains the primary commodity of interest, it is also an advanced-stage fluorspar deposit.

Historical drilling on Saville‘s adjacent property has intersected long intervals of high-grade fluorite.

Fluorite is the industrial mineral known as fluorspar, from which the two primary commercial grades are produced and traded globally: Metallurgical grade fluorspar (“met-spar“; 60-97% CaF2) and acid-grade (“acid-spar“; +97% CaF2), which normally sells at a premium. While met-spar is primarily used in steel production, acid-spar is used in aluminium production, amongst many other industries.

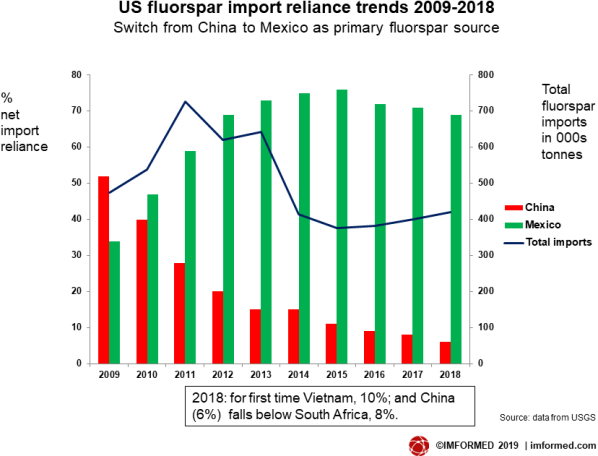

Québec is the world‘s second largest aluminium exporter (+80% goes to the US), and also a major steel producer with large iron ore mines located near-by at the Labrador Trough. With Commerce‘s and Saville‘s properties also located in Québec‘s Labrador Trough, a reliable long-term fluorspar source would be all the more welcome to the province‘s aluminium and steel industries. The world‘s biggest fluorspar producer, China, has recently become a net importer, causing significant price increases and end-users looking for new sources.

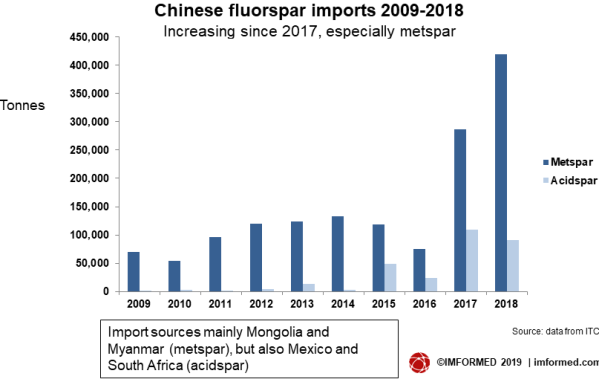

In September 2019, acid-spar traded between $430-500 USD/t (97% CaF2, FOB China). “Chinese fluorspar spot prices for both metspar and acidspar have reached multi-year highs in 2018 and 2019, with lower-grade metspar sometimes bizarrely costing more than >97% purity acidspar. The turnaround in supply/demand was dramatic... The price of fluorspar generally is on a long-term upward trend.“ (Roskill, November 2019)

Acid-spar accounts for 60-65% of global fluorspar production and the 2 main industry applications are (1) the manufacture of hydrofluoric acid (HF), the primary source of all fluorochemicals, and (2) the manufacture of aluminium fluoride (AlF3) for aluminium smelters. Met-spar accounts for about 37-40% of the fluorspar market with the main application for steel smelters. (Source)

Commerce Resources Corp. recently provided an update on its metallurgical program focused on upgrading the Ashram REE Deposit‘s fluorspar content to acid-spar grade. This program has been underway for several weeks and is being completed in part due to “requests from the industry for acid-spar grade fluorspar samples“, the company noted and added that “this interest has been increasing in recent quarters along with the price of the commodity“.

The work may also improve recoveries of the REEs into the primary REE mineral concentrate as the current fluorspar concentrate still contains some REE minerals that will be removed during the upgrading to acid-spar.

Further, considering the state of the fluorspar market and the historical high-grade fluorspar drill intersections at its Mallard Prospect on its niobium property, it‘s no wonder why Saville Resources Inc. is now also putting some focus on its fluorspar potential (see today´s news).

However, it‘s all the more a wonder that fluorspar – the industrial mineral deemed critical by governments worldwide – is practically unknown to the investment world, despite alarming supply-demand fundamentals, a market price that is poised to escalate over the next years, and its vital, irreplaceable importance for many key industries such as aluminium, steel, cement, and fluorochemical derivatives. Note that fluorspar also plays a pivotal role in the performance of lithium-ion batteries, a relatively new sector putting even more pressure on fluorspar‘s limited supply side.

Similar to the meteoric rise of rare earths in 2010, followed by lithium, cobalt, and graphite, there‘s a distinct possibility that fluorspar will soon be getting the attention it deserves as it may just be the most important and least known industrial mineral today. It‘s part of everyone‘s life, but most people and investors don‘t understand what it is.

Despite few public companies focusing on fluorspar today, global exploration for new fluorspar sources is anticipated to increase sharply over the next years and as such investors will have the opportunity to participate in the pulsating fluorspar market, especially when doing their homework of getting to know all about this critical mineral.

The Elixir For Major Industries

Of all the known elements, fluorine is the most chemically reactive element and as such it does not surprise that global fluorspar demand is dominated by the chemical industry. Fluorspar is an essential raw material in many modern consumer products. As an example, an estimated half of all new medicines contain fluorspar derivatives.

Fluorspar (the Latin verb “fluo“ means “flow“) is heavily used for the production of aluminium and steel. Acid-spar is used to manufacture aluminium fluoride (AlF3), which acts as a flux to lower the bath temperature in the production of aluminium. Met-spar acts as a flux in steel production to lower the melting temperature and increase the chemical reactivity to help the absorption and removal of sulphur, phosphorous, carbon, and other impurities in the slag. Other applications further downstream are refrigerants, ceramics, glass, plastics, healthcare equipment, construction materials, electronics, motor vehicles, pharmaceuticals, and other fluorochemical derivatives.

For many key industries, there exist no substitutes for fluorspar. As fluorspar is consumed by the industry, it cannot be recycled, it must be mined.

China is using up its depleting mine supplies at such a fevered pace, the government has put restrictions in place to reduce fluorspar exports, becoming a net importer in 2017.

Abundant But Rare

Fluorine‘s (F) abundance in the solar system is exceptionally low. However in the earth‘s crust, it‘s one of the more abundant elements and is widely dispersed in nature. Elemental fluorine does not occur naturally. Instead, all fluorine exists as fluoride-containing minerals. Many fluorine-bearing minerals are known, but of paramount commercial importance is fluorite (CaF2).

Mined fluorite does not require sophisticated hydrometallurgical processing and only requires physical upgrading to a high enough purity for the target end-use. Although fluorite occurs in many places around the globe and is not uncommon, there are only few significant primary fluorspar mines in operation today. This is because it is rare to find high-grade (+20%) CaF2 in large enough quantities to justify a primary mine with an upgrading facility.

In addition to primary mines, fluorspar may also be produced as a by-product from mining other commodities. For example, Bayan Obo (China) – the world‘s largest REE deposit and the 2nd largest niobium deposit – is also the largest fluorspar deposit. Bayan Obo is characterized as a carbonatite host rock, which is also the host rock at Commerce‘s and Saville‘s properties.

Carbonatites are unusual rocks and relatively rare globally, consisting largely of magmatic calcite (or dolomite), but may contain a wide variety of other minerals, many of which occur in concentrations that are of economic value for the production of fluorspar, REEs, niobium and tantalum – all of which have been classified as “critical minerals“ by the US and EU governments, and occur on both Commerce‘s and Saville‘s properties.

Another carbonatite-hosted fluorspar deposit is Okorusu in Namibia – for many years the world‘s largest fluorspar mine with 7 identified ore bodies. The Belgian chemical company, Solvay S.A., acquired Okorusu in 1988, producing around 100,000 t of acid-spar annually. In 2014, the mine closed; after 26 years the higher grade ore resources were depleted in the pit. An estimated 7 million t of resources are left with an average grade of 27.5% CaF2, potentially mineable by underground methods. Okorusu is now privately held.

Many of the Mexican fluorspar mines are replacement deposits, where carbonate rock was altered to fluorspar.

Mexican supply requires additional costly refining to remove arsenic, which is unique to Mexican fluorspar. There are only 4 plants in the world that can complete the arsenic removal process, Honeywell and DuPont each own one – as such it does not surprise that Mexico is exporting most of its fluorspar to the US, where both Honeywell and DuPont use fluorspar to produce fluorochemicals such as fluorocarbons and fluoropolymers.

China and Mexico are the largest fluorspar producers globally, accounting for about 80% of total supply. As China has become a net importer of fluorspar and Mexico is exporting almost all of its fluorspar output to the US for the production of fluorochemicals, the supply side appears extremely tight for other end-users, such as Québec‘s large aluminium and steel industries.

Aluminium

• Canada‘s primary aluminium industry is the 4th largest in the world with an annual production of 3.2 million t.

• Canada is the world‘s 2nd largest aluminium exporter (84% of primary aluminium exported to the US).

• Aluminium from Canada has the lowest carbon footprint, making it the greenest aluminium in the world thanks to its ready access to hydroelectric power. Primary aluminium produced in Québec generates 67% and 76% less greenhouse gas than in the Middle East or China, respectively, which are the world‘s 2 largest producers of primary aluminium and mainly use coal energy to produce it.

• Nearly 90% of Canadian aluminium is produced in Québec.

• Alcoa, Rio Tinto and Aloutte operate 8 aluminium smelters in Québec, producing 2.9 million t of primary aluminium, or 60% of total North American production.

• Aluminium is a strategic Québec industry, providing 30,000 jobs in 8 smelters, +1,400 processing companies, 923 OEMs, 684 suppliers, 76 equipment suppliers, 132 recyclers and 8 centres of research, development and training.

• Aluminium is the second largest industry in Québec (after aerospace). The delivery value of aluminium products is upwards of $5 billion, which represents a sizeable revenue for Québec’s economy.

• In 2015, the Government of Québec announced the launch of the Québec Aluminium Development Strategy to promote the growth and enhancement of the entire aluminium value chain, including the mandate to double aluminium processing in Québec until 2025.

• China accounted for 65% of global aluminium tri-fluoride (AlF3) supply in 2018, when worldwide demand was 1.1 million t. Demand for AlF3 in aluminium smelting is likely to be maintained for the foreseeable future as aluminium production continues to undersupply demand.

Steel / Iron Ore

• In 2017, Canada was the 9th largest producer of iron ore in the world with 49 million t, ranking 7th in terms of iron ore reserves (6 billion t).

• Canada exported 43.1 million t of iron ore (valued at $4.6 billion) in 2017 while the Canadian steel industry exported 7 million t of semi-finished and finished steel products.

• The Canadian steel industry employs more than 23,000 people and is a vital supplier to the nation‘s manufacturing, energy, automotive and construction sectors.

• +99% of Canada‘s iron ore comes from the Labrador Trough region. Québec (51%) accounted for most mine production (shipments) of iron ore, followed by Newfoundland & Labrador (44%) and Nunavut (5%).

• Commerce‘s and Saville‘s properties are also located within the Labrador Trough, the same geological belt where global majors including Rio Tinto, ArcelorMittal, Tata Steel, and Champion Iron operate large open-pits.

• The Labrador Trough has a long production history: +60 years of profitable operations, producing +2 billion t of iron ore. Today, +80 billion t of known iron ore resources exist near surface with vast exploration potential.

• Labrador Trough enjoys ample water resources, reliable sources of low-cost hydroelectric power, and a key transportation infrastructure with excess rail and port capacity.

• High-quality: Iron ore from the Labrador Trough has a superior quality relative to Australian (world‘s largest iron ore producer) and Brazilian (2nd largest producer) product, offsetting freight disadvantage (for China markets). Canadian iron ore is high-grade with few impurities, such as phosphorous, alumina, sulphur, and alkalies. Nevertheless, Canada‘s steel industry is a large fluorspar consumer as the industrial mineral is used heavily in smelters to reduce the melting temperature and to increase the chemical reactivity.

• Lower-grade iron ores typically have higher impurities generally requiring more coking coal – a key ingredient in blast-furnace steel manufacturing.

• Therefore, higher-grade ores help steel mills reduce harmful emissions. That makes iron ore from the Labrador Trough a very attractive value proposition for steel-makers who seek to strike a balance between productivity, profitability and emissions.

• Steel-making will always be an important market for met-spar. World crude steel production was 925 million t in the first 6 months of 2019, up by 4.9% compared to the same period in 2018, mainly driven by China and India. In 2020, global steel demand is projected to reach 1.8 billion t.

Fluorochemicals

Fluorine raw material demand is dominated by the chemical industry with its requirement for hydrofluoric acid (HF) as a precursor to a wide range of chemical products, including AlF3 for the aluminium industry. For this, acid-spar is essential.

Fluorochemical markets range widely and include fluorocarbons (e.g. refrigerant gases, propellants), electrical and electronic appliances, mining/metallurgical industry (extraction, manufacture and processing), lithium-ion batteries, pharmaceuticals, polymers, and agrochemicals. The largest chemical sector application for HF is in the production of fluorocarbons. Overall, production of fluorocarbons is estimated to have consumed approximately 1 million t of HF in 2017, requiring >2 million t of acid-spar. (Source)

Lithium-Ion Batteries

According to IMFORMED Industrial Mineral Forums & Research (2019):

“Fluorine-based compounds are now being used in the emerging and fast growing Li-ion battery market: fluoropolymers in high performance binders and separator coatings, and fluorinated salts in the electrolyte.

Polyvinylidene fluoride (PVDF) is a highly non-reactive thermoplastic fluoropolymer produced by the polymerisation of vinylidene difluoride. PVDF is a speciality plastic used in applications requiring the highest purity, as well as resistance to solvents, acids and hydrocarbons. PVDF is used in the binders of the Li-ion cell at low concentrations helping to achieve higher energy density and a longer battery life cycle. In order to extend cycle life with a better interface between electrodes and separator as well as to achieve enhanced wettability and easy assembly, Li-ion cell separators can be coated with an additional layer of PVDF.

The use of fluorine in various compounds has become a key element in the electrolytes of Li-Ion batteries ... used as coating additives on the anode. Owing to their excellent chemical/thermal stability and conductivity, lithium imide salts containing fluorine ... are being developed and used as an additive or main lithium salt to improve performance and safety of Li-ion batteries’ liquid electrolyte.“

Fluorspar + Québec = Perfect Match

Many people know that fluoride prevents tooth decay, repairs cavities, has a distinctive bitter taste and is toxic when consumed in large quantities.

Few people know that fluorspar is a key ingredient to some of our most important (and largest) primary manufacturing industries – aluminium, steel, fluorochemicals and more recently the soaring lithium-ion battery market (“one of the best kept secrets in the battery metals mix“ as most investors have not yet realized that fluorspar is a vital component in lithium-ion batteries).

It‘s a rare opportunity that even fewer people know that Commerce and Saville are advancing also with their fluorspar opportunities trying to become the perfect match for Québec hitting the sweet spot for its aluminium and steel industries. A reliable fluorspar source in the same province would arguably be a missing key for Québec as the provincial government aims to expand both its aluminium and steel industries.

An owl carved from purple fluorite. “The National Assembly adopted the snowy owl (Nyctea scandiaca) as Quebec‘s official bird in 1987. Unlike other owls, the snowy owl isn‘t exclusively nocturnal. It hunts both day and night, surviving mainly on lemmings. Quebec decided to select the snowy owl as a symbol of the province‘s support for wildlife protection.“ (Source)

Bottom Line

“The global fluorspar market is poised to have an astronomical growth during the forecast period (2018-2023)“, concluded Market Research Future in its latest fluorspar report (November 2019).

Fluorspar is a valuable commodity with a global market value of around $3 billion USD. Yet fluorspar‘s true value lies in the multiple downstream levels that can significantly uplift it with a market value estimated at $112 billion USD, where it is oftentimes used as an indispensable component.

“Depleting high quality fluorspar reserves, high cost of acidspar production, and likely continued pressure and perhaps further capacity reductions in China, combined with continuing demand for fluorspar in chemical, steel and aluminium markets mean that there is a case for alternative and new fluorspar sources to come on line.“ (IMFORMED Industrial Mineral Forums & Research, 2019)

South Africa is home to the largest fluorspar reserves in the world, however its export market is primarily to Europe for the manufacture of hydrofluoric acid (HF) for the chemical industry, which in turn uses HF for example for the manufacture of aluminium tri-fluoride (AlF3) for the aluminium industry.

In August of this year, privately-held Sepfluor Ltd. and its Nokeng Fluorspar Mine in South Africa entered the fluorspar supply arena as one of only three significant production newcomers over the past 10 years. The hematite-fluorspar deposit requires a unique flotation process to produce about 180,000 t of acid-spar and 30,000 t of met-spar annually. The estimated mine-life of 19 years is based on reserves of 12.2 million t with an overall grade of 27% CaF2.

Overall, the high-grade historical CaF2 drill intercepts on Saville‘s property and Commerce‘s already produced met-spar concentrate appear highly promising, especially when considering the targeted primary commodities are REEs (Commerce) and niobium (Saville). Although the fluorite grades within Commerce‘s Ashram REE Deposit would be too low to justify a primary fluorspar mine, it occurs along with strong grades of REEs, thus making fluorspar a by-product target. Drill intercepts such as 235.35 m of 1.92% TREO and 9.8% CaF2 (hole EC15-133) showed high grades of middle and heavy rare earth oxides along with appreciable fluorite grades occurring near surface over the entire hole (from 3.65 m to 239 m).

Moreover, Ashram‘s resource estimate of 1.6 million t at 1.77% REO and 3.8% F (7.7% CaF2) in the measured category, 28 million t at 1.90% REO and 2.9% F (5.9% CaF2) in the indicated category, and 220 million t at 1.88% REO and 2.2% F (4.5% CaF2) in the inferred category make it not only one of the world‘s largest REE resources but also one of the largest fluorspar resources globally. Such a big deposit brings the potential to have a mine-life of +100 years.

Follow Commerce and Saville

An increased newsflow from Commerce‘s fluorspar upgrading program is expected over the next weeks, including results – in case these turn out positive, the production of samples for potential end-users‘ evaluation may follow.

Ashram‘s current REE flowsheet effectively produces a met-spar product at no additional cost – it has no negative impact on the REE recovery to the primary REE concentrate. The sale of the fluorspar would reduce the footprint of the project’s tailings management facility as well as provide another revenue stream while also serving as a source of secure supply for the market.

“The economic aspect of a fluorspar by-product was not considered in the Preliminary Economic Assessment (effective date July 2012, revised date January 2015); however, based on the flowsheet development since this time, as well as market fundamentals, is anticipated to be evaluated as part of a Prefeasibility Study“, Commerce stated on November 16. The target is to reduce capital and operating costs, making a mining decision even more attractive to potential strategic partners / end-users.

Historical drilling on Saville‘s property showed higher fluorite grades compared to Ashram. This year‘s drilling by Saville encountered impressive niobium results, outshining previous holes and many other niobium projects globally, whereas the core was not analyzed for fluorine (i.e. fluorite content) – not yet as the company indicated today, thus news in this respect could follow soon. Further drilling at Mallard as well as several other high-priority targets, including Miranna, is planned as part of Phase II.

In today‘s news, Saville quoted from the recent Technical Report (2018) on the Niobium Claim Group Property: “The encouraging intersections of fluorite mineralization discovered in 2008, in drill holes EC08-015 and 016, were further expanded in 2010, with all four holes intersecting the unit. Drill holes EC10-033 and 044 returned some of the highest-grade intercepts to date. The fluorite zones remain to be modeled and intercepts correlated; however, the data indicates a strong potential for a fluorite zone of significance to be present. Further, although intersected at depth, the mineralization has potential to extend to surface given the sizable intervals over multiple holes, and the moderate to steep dip interpreted for the unit.”

Many Investors Missed Out Before

In August of last year, Canada Fluorspar Inc. reopened the St. Lawrence Fluorspar Mine on the island of Newfoundland, off the east coast of the North American mainland. Shipments of acid-spar were dispatched to the US. After ramp-up and mill commissioning, an annual production of 200,000 t acid-spar is planned at St. Lawrence Mine’s full capacity, with a projected mine-life of 30 years. An Updated Preliminary Feasibility Study (2013) demonstrated narrow, high-grade veins hosting 9.1 million t with an average grade of 42% CaF2 (Indicated) and nearly 1 million t at 31.1% CaF2 (Inferred).

In 2014, Canada Fluorspar was acquired by US-based private equity firm Golden Gate Capital in an all-cash deal at a price of $0.35/share (~66% premium to its prior trading range). This values the deal at $39 million, based on 111 million shares issued and outstanding at that time. The stock was delisted shortly thereafter. What a great buy for Golden Gate Capital!

If fluorspar was better known to investors back then, maybe the sale price would have been much higher considering the magnitude of the St. Lawrence Mine projections (200,000 t acid-spar x $500 = $100 million annually x 30 years = $3 billion USD).

Golden Gate Capital, based in San Francisco, USA, is a privately-held holding company with over $15 billion USD in committed capital, growing its businesses through investments and operational improvements. The company has investments in +35 companies across 6 industry verticals.

As the fluorspar market is currently all about securing reliable long-term supply, the principle “first come, first served“ holds true in terms of acquiring promising mine and development projects in safe jurisdictions, and ultimately deciding where shipments will be dispatched to.

Consequently, the pressure on Québec is increasing to find such a fluorspar supply for its large aluminium and steel industries. The US, Europe and China appear somewhat more advanced in this respect, having made arrangements in an attempt to protect their respective industries by locking in mine supply. The race is on and gaining heat – unnoticed by most investors.

Full size / Blue and purple fluorite from the Southern Illinois Fluorspar District, once the largest fluorspar-producing region in the US, where unusually high-grade fluorite was mined until the early 1990s at shallow depths and carbonatite-related fluorspar deposits occur at depth along with elevated REE contents (information about the deep fluorspar ores is largely confidential and little has been published. It is uncertain whether the deep fluorspar ores will be mined because the depth at which they occur is 600 m or more). The fluorite at Saville‘s Mallard Target within the Niobium Claim Group Property is purple in colour and may be pervasive to banded within its carbonatite host rock. Fluorite in Commerce‘s A-Zone within the Ashram REE Deposit is typically abundant and pervasive, occurring as disseminations, blebs, patches, veins, and fracture fillings, while in the B-Zone fluorite is present occasionally as locally abundant patches or blebs and may lend a bluish hue to the rock where present; sulphides are rare.

Company Details

Saville Resources Inc.

#1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: mhodge@savilleres.com

www.savilleres.com

Shares Issued & Outstanding: 63,415,400

Canada Symbol (TSX.V): SRE

Current Price: $0.025 CAD (11/25/2019)

Market Capitalization: $2 Million CAD

Germany Symbol / WKN (Frankfurt): S0J / A2DY3Z

Current Price: €0.011 EUR (11/25/2019)

Market Capitalization: €1 Million EUR

Previous Coverage

Report #9: “Saville reports impressive niobium drill results from Quebec, outshining previous holes and many other niobium projects globally“

Report #8: “On A Winning Streak In The Midst Of Trade Wars: Saville Drills High-Grade Niobium In Quebec“

Report #7: “Saville to start drilling for a niobium discovery in Quebec“

Report #6: “Saville Discovers High-Grade Niobium-Tantalum Boulders, And Possibly The Source, Ahead Of Drilling“

Report #5: “Strong potential for discovery of niobium-tantalum deposit(s) of significance, says independent report filed today“

Report #4: “Saville Releases High-Grade Assays from the Niobium Claim Group“

Report #3: “Eager to Start the Treasure Hunt for Niobium in Quebec“

Report #2: “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #1: “Saville Resources: Getting Ready“

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 41,476,083

Canada Symbol (TSX.V): CCE

Current Price: $0.14 CAD (11/25/2019)

Market Capitalization: $6 Million CAD

Germany Symbol / WKN (Tradegate): D7H0 / A2PQKV

Current Price: €0.10 EUR (11/25/2019)

Market Capitalization: €4 Million EUR

Previous Coverage

Report #30 “Lean and Mean: A Fighting Machine“

Report #29 “Like A Phoenix From The Ashes“

Report #28 “SENKAKU 2: Total Embargo“

Report #27 “Technological Breakthrough in the Niobium-Tantalum Space“

Report #26 “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #25 “The Good Times are Back in the Rare Earths Space“

Report #24 “Commerce Resources and Ucore Rare Metals: The Beginning of a Beautiful Friendship?“

Report #23 “Edging China out of Rare Earth Dominance via Quebec‘s Ashram Rare Earth Deposit“

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Saville Resources Inc., Commerce Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Saville Resources Inc.´s and Commerce Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through their respective profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here and here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Saville Resources Inc., Commerce Resources Corp. and Zimtu Capital Corp., and is being paid by Zimtu Capital Corp., which company also holds a long position in Saville Resources Inc. and Commerce Resources Corp. Note that Saville Resources Inc. and Commerce Resources Corp. pay Zimtu Capital Corp. to provide this report and other investor awareness services. Also, Zimtu Capital Corp. is an insider and control block of Saville Resources Inc. by virtue of owning more than 20% of Saville Resources Inc.’s outstanding stock. The cover picture has been obtained from Potapov Alexander and the picture of the blue-violet fluorit specimen has been obtained from Albert Russ.