“[The] demand for smaller, more powerful electronic components has become a defining characteristic of the industry. At the heart of this miniaturization trend lies tantalum pentoxide, a vital and often unsung hero in modern electronic engineering.“ (Source)

Disseminated on behalf of Capacitor Metals Corp. and Zimtu Capital Corp.

Nvidia, the global leader in artificial intelligence computing and the world‘s second most valuable company with a market capitalization in excess of $3 trillion USD, owes its success in part to the unique properties of tantalum. This rare high-tech metal is essential for computer chips, which are critical to the operations of Nvidia and other major chip manufacturers in China and Taiwan. The unsung hero as a technology-critical metal is starting to make waves in the markets as investors are realizing its rapid growth in the electronics industry, particularly the increasing need for tantalum capacitors. Today, a mind-boggling 75% of all electronic components contain tantalum. The artificial intelligence era would come to an abrupt end without tantalum. And yet most tantalum comes from artisanal and small-scale mines, where alluvial deposits have been heavily depleted after decades of surface mining. Alarmingly, the industry is quietly but urgently seeking a stable and reliable source of tantalum capable of delivering substantial and consistent production for decades. This pressing need is the driving force behind the formation of Capacitor Metals Corp., with the Blue River Tantalum-Niobium Project emerging as the leading development initiative in the Western World.

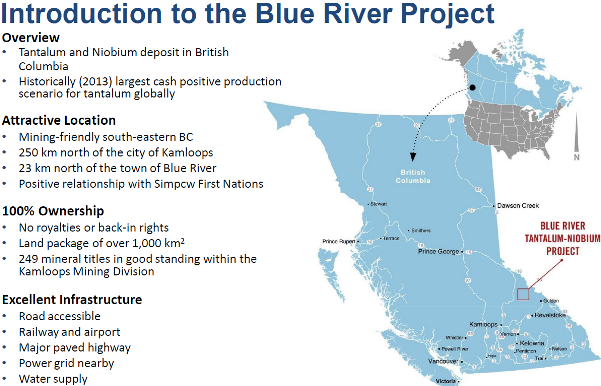

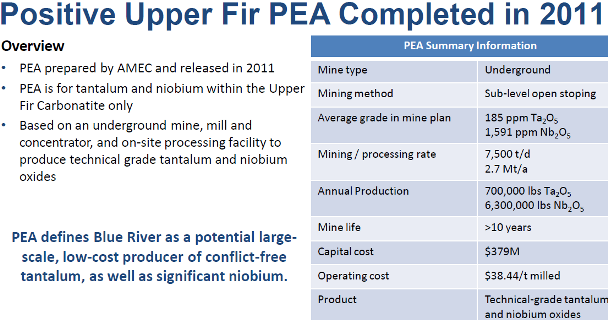

The Blue River Project is being positioned as the world‘s largest and most cost-effective potential near-term supplier of conflict-free tantalum, offering substantial niobium by-product credits. Historically, it boasts the largest cash-positive production scenario for tantalum worldwide. Located in mining-friendly British Columbia, the advanced-stage project benefits from excellent infrastructure.To date, over $34 million has been invested in the Blue River Project.

As announced in mid-June, the newly founded company Capacitor Metals Corp. acquired 100% of the Blue River assets from Commerce Resources Corp. (TSX.V: CCE) for 20 million shares. Capacitor Metals is a private company with intent to go public, focussing on the advancement of the Blue River Project which includes the Upper Fir Deposit.

Today, Capacitor Metals Corp. announced the appointment of Chris Grove as President and CEO effective immediately. Mr. Grove, as the former President and CEO of Commerce Resources Corp., has over 20 years’ experience with the developments of the Blue River Project.

Dave Hodge commented in today‘s news-release: “As the founder of this company, I am pleased to have Chris Grove take the reins as we move this project forward to success. With his 25 years of experience and the relationships he has grown globally in the tantalum, niobium and rare earth communities, the company has assembled a very impressive team heading into the future.”

Chris Grove added: “It is my distinct pleasure to be a part of the Capacitor Metals team and to lead the ongoing developments of the Upper Fir Tantalum & Niobium Deposit. This significant resource has received an increase of interest recently due to the fundamental shift in global supply and demand, and we look forward to releasing more details on developments for the Upper Fir Deposit.“

As Commerce Resources is putting all of its focus into the completion of an updated PEA (“Preliminary Economic Assessment“) for its Ashram REE-Fluorspar Deposit in Quebec, the company is showing gratitude to its loyal shareholders with plans to distribute all 20 million Capacitor shares to them on a pro rata basis at a later date. Consequently, holding shares of Commerce Resources could prove advantageous.

Additionally, there may be further benefits in participating in the private placement financing that Capacitor Metals announced recently. The company intends to finance the ongoing exploration and marketing of the Blue River Project with a five-cent private placement unit for up to $2 million. This financing will facilitate an updated NI 43-101 Technical Report and a new strategic plan to move the company forward. The financing will rely on exciting exceptions and preference will be given to shareholders of Commerce Resources Corp. and Zimtu Capital Corp., as well as subscribers of Rockstone.

With this rare opportunity, investors can participate in the development of the advanced-stage Blue River Project by way of investing early in a private company with intent to go public.

Capacitor Metals is considered to be the only pure-play tantalum junior available for investment at the moment, with no other public companies known in this sector.

As Capacitor Metals has closed a seed-round financing previously, the company was able to complete a field program in April 2024 with a new NI 43-101 Technical Report expected shortly (one of the requirements for seeking a public listing on a Canadian stock exchange).

Any disposition of the Blue River Shares will, if undertaken, be conducted in compliance with applicable corporate and securities laws, and the policies of the TSX Venture Exchange. Completion of the Blue River Transaction is subject to the conditions set forth in the Purchase Agreement, including, if required, acceptance by the TSX Venture Exchange.

Blue River Project Highlights

• One of the world‘s leading ESG-focused tantalum and niobium projects. World’s largest and low-cost potential near-term supplier of conflict-free tantalum.

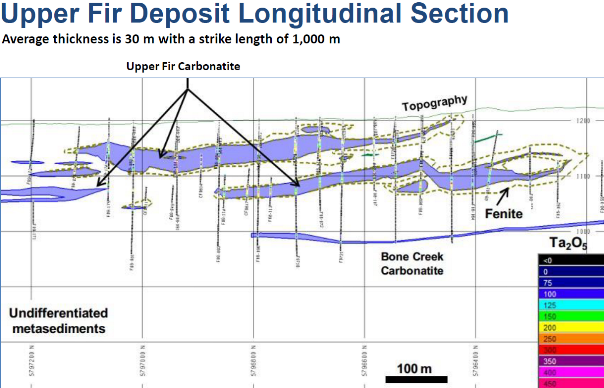

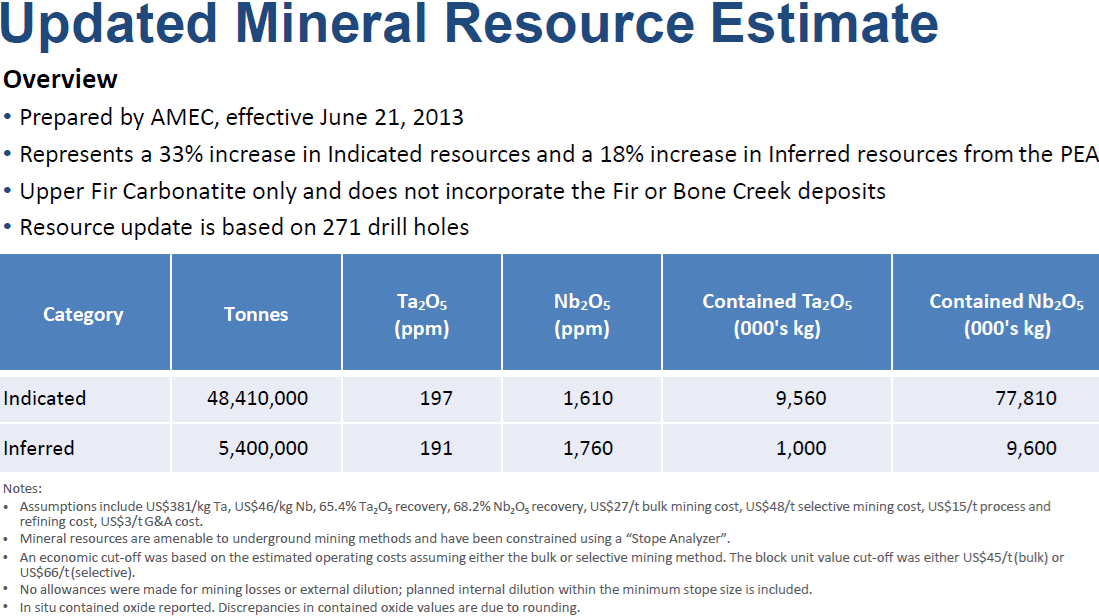

• Advanced project with significant work complete. Over $34 million spent to date, including 271 drill holes (59,110 m), a historical Preliminary Economic Assessment (“PEA”), community consultations, and preliminary metallurgical and environmental work.

• PEA completed on the Upper Fir Deposit, defining a low capital expenditure project that could produce 700,000 lbs Ta2O5 annually, outlining its potential to be the world’s largest tantalum producer (2,500 t per day from one portal; mine life >30 years with current resource).

• Expansion potential to Upper Fir, Fir and additional deposits provides further production upside.

• Property contains 3 known deposits of tantalum and niobium and an additional >20 known exploration targets.

• Upper Fir Deposit has a significant Indicated Resource of 9.6 million kg contained tantalum and 77.8 million kg contained niobium plus Inferred Resources of 1 million kg contained tantalum and 9.6 million kg contained niobium.

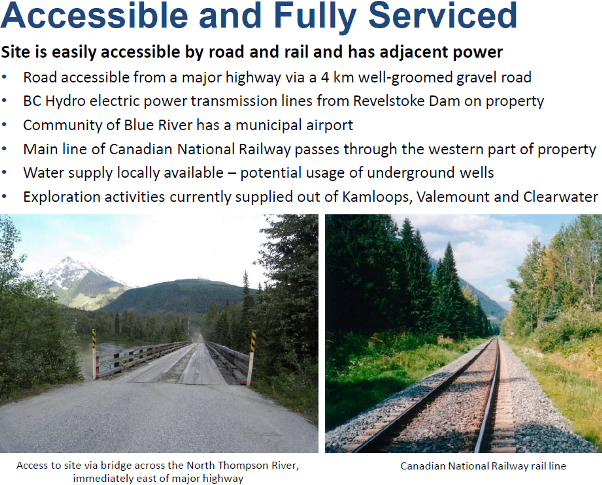

• Fully serviced site in mining-friendly British Columbia, Canada.

• Minimal infrastructure needs – rail, paved road, water and power adjacent to project site.

• Strong management team with extensive experience in tantalum markets.

• Well-understood geology and mineralization as hosted in carbonatites similar to other world-class carbonatite-associated deposits such as Mountain Pass in California (REE, barium), Niobec and Oka in Quebec (niobium, REE), Cargill in Ontario (phosphate), as well as Araxa and Calalao in Brazil (niobium, phosphate, REE).

• Primary economic minerals: Ferrocolumbite and pyrochlore.

• Metallurgical improvements: Estimated overall final recovery rates increased to 77.2% for tantalum and 75.1% for niobium (2013) against PEA base case of 65-70%.

Central Africa‘s Role in Tantalum Supply Chain Concerns

• Artisanal and small-scale mine production accounts for about 60% of global tantalum output.

• Global tantalum mine production is highly concentrated, creating a substantial risk of supply disruptions. Last year, rebels took control of a major tantalum mining hub in the Democratic Republic of Congo (DRC), disrupting mining operations in the area.

• Since 2009, the Great Lakes region in central and east Africa (mainly DRC and Rwanda, and to a lesser extent Burundi and Uganda) has been the world‘s largest producer of tantalum ore.

• Tantalum production in the Great Lakes region accounts for about 50% of global tantalum mine output.

Full size / Source / Hand-picking of coltan (short for columbite-tantalite) from alluvial deposits in the Great Lakes region: A dull black metallic ore from which the elements niobium and tantalum are extracted.

Full size / Source

• Tantalum production from the Great Lakes region has been falling over recent years due to the fact that production predominately takes place in an artisanal and small-scale mining setting with alluvial deposits increasingly depleting after decades of exploitation.

• Most tantalum mineralization in the Great Lakes region is hosted by granite-related pegmatite deposits, forming dikes and sills of variable thickness (rarely >10 m) and length (rarely >2 km). Only the weathered upper portion of the ore body is typically targeted by artisanal miners.

• Weathering of the upper ore body caused eluvial enrichment of tantalum, supporting widespread artisanal mining activities. Alluvial reworking lead to the formation of tantalum placers – a significant artisanal production component. These secondary eluvial or alluvial processes make the pegmatite ore suitable for ground sluicing and panning, the most common processing techniques used by artisanal miners. These hydraulic techniques allow artisanal miners to process large volumes of ore.

• In the Great Lakes region, artisanal mining has progressively reduced eluvial and alluvial tantalum resources. Many secondary-enriched deposits have already been depleted by decades of artisanal mining.

• Mining of the remaining primary hard-rock pegmatite mineralization requires different production parameters, such as high-volume crushing and magnetic separation, which is typically not available to artisanal miners as it requires higher capital expenditures compared to alluvial mining (hand-picking of weathered/separated minerals).

• Only few pegmatites in the Great Lakes region show potential for development as industrial mines as the mineralized dikes/sills must be thick or long, or must have accumulations of a large number of dikes/sills, in order to warrant building a mine including a processing facility. For example, the Ntunga Tin-Tantalum exploration project in Rwanda hosts JORC-compliant resources of 9.2 million tons at a tantalum grade of 200 g/t, which is a rather small to medium-scale tonnage. The giant Manono pegmatite system in the DRC is an exception (multi-branched mineralized pegmatites span over a length of 15 km, a width of 800 m, and a depth of at least 100 m), comprising a total resource of 400 million t, however the tantalum grades are very low (30 g/t).

Tantalum: High-Tech Metal in Strong Demand

• Tantalum “is a key ingredient in the world of electronics, enabling the miniaturization of electronic devices while maintaining high performance and reliability. Its unique properties, such as high capacitance, stability, and insulating capabilities, make it an indispensable component in the production of capacitors and semiconductor devices. As the demand for smaller, more powerful electronics continues to grow, tantalum pentoxide will remain a crucial player in the ever-shrinking world of electronic components.“ (Source)

• Main uses: Capacitors (44%), Engine Turbines (22%), Semiconductors (10%), Chemical Processing Equipment (6%).

• “The need for capacitors is rising due to a variety of electronic equipment, such as computer motherboards, switching mode power supply, inverter main circuits, and control circuits.“ (Source)

• “The global capacitor market was estimated at a value of US$ 31.7 billion in 2021. It is anticipated to register a 6.4% CAGR from 2022 to 2031 and by 2031, the market is likely to attain US$ 58.67 billion... One of the key reasons that is anticipated to propel the capacitor market in the coming years is the growing demand for capacitors from the consumer electronics industry. In order to satisfy the demands of contemporary society, portable consumer electronics, such as mobile phones and cameras, are developing quickly. Capacitors are becoming more wearable, lighter, thinner, flexible, and tiny. Supercapacitors have the benefit of high-speed energy discharge, which makes them desirable power supply for portable electronic devices, and they can store almost as much energy as batteries.“ (Source)

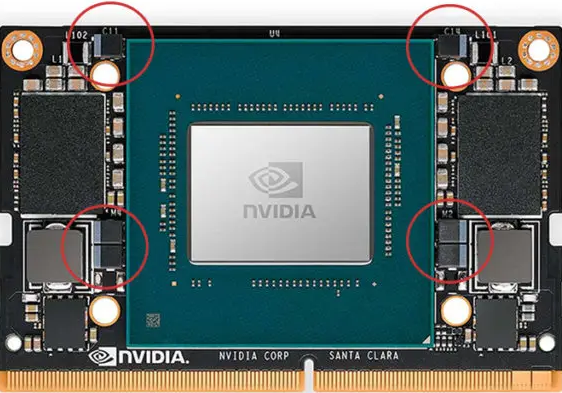

Full size / Nvidia Jetson Xavier NX module with 6 tantalum capacitors on the board. According to “Tantalum Capacitors Support Nvidia to Shrink AI ‘Supercomputer’ to Credit Card Size“ (2022): “[There] are some three strong pillars for tantalum capacitors based on their features: 1. High stability of its parameters; 2. Long-term reliability; 3. High energy and power density. While high volume consumer market is trying to replace tantalum capacitors due to the higher cost there are still number of applications where use of tantalum capacitors presents key competitive advantage within consumer-industrial applications (such as high energy compact capacitors in SSDs and industrial computers) and high reliability and defense sector. There were two web articles that grab my attention this morning as puzzle piece to complete the picture. The first release from Nvidia on “industrial” supercomputer above and also nice overview of defense industry technology innovation from Jabil blog discussion role of defense in driving the technology innovation. The blog mentions four technology innovations impacting the defense industry: 1. Augmented and Virtual Reality; 2. Big Data and the Internet of Things; 3. Artificial Intelligence; 4. Additive Manufacturing. The Jabil blog goes nicely with the Nvidia press release citing Lockheed Martin’s acknowledgement for the AI supercomputer development... and at the end is a good message for tantalum capacitor industry.“

• “[The] tantalum mining industry has faced ethical and environmental concerns in some regions, leading to calls for more responsible sourcing practices. Many manufacturers have responded to these concerns by implementing responsible sourcing...“ (Source)

• Ethically sourced tantalum is a high-tech metal that is extracted and traded under conditions that ensure the protection of human rights, the environment, and fair labor practices, often involving transparent supply chains that avoid supporting conflict zones or exploitative practices.

• “Tantalum is a rare metal with the atomic number 73, known for its grey colour, heaviness, and exceptional hardness. It is among the most corrosion-resistant metals, forming an oxide layer when exposed to air, making it resistant to strong and hot acid environments. The rare metal‘s highly corrosion-resistant property makes it suitable for use in corrosive environments. This property is advantageous in electronic components that may be exposed to harsh conditions or reactive substances. Pure tantalum is ductile, allowing it to be stretched into thin wires without breaking. Notably, it is nearly impervious to chemical attack at temperatures below 150°C, as per media reports citing the US Department of Energy.“ (Source)

• “Tantalum has several other properties that make it valuable in various electronic and semiconductor applications. Tantalum capacitors are one of the most common applications of tantalum in electronics. Tantalum capacitors offer more electricity storage in a small volume and are often used in compact electronic devices such as smartphones, laptops, and other portable electronic devices. They provide stable capacitance over a wide temperature range and have low leakage currents. The rare metal is also used in the production of semiconductors, where it is employed as a thin film for insulating layers. Tantalum oxide films, for example, are used as materials in metal-insulator-metal (MIM) capacitors and other semiconductor devices. These films make the semiconductor devices suitable for use in high-performance electronic components. Tantalum‘s high melting point makes it useful in applications where extreme conditions are encountered. It is often used in the production of components for high-temperature environments, such as in the aerospace and defence industries. Due to its high melting point, tantalum serves as a cost-effective substitute for platinum. It finds applications in chemical plants, nuclear power plants, aircraft, and missiles. It is also used in some medical devices, particularly in the production of implants. Its biocompatibility and corrosion resistance make it suitable for applications such as bone implants and stents... A composite consisting of tantalum carbide (TaC) and graphite is one of the hardest materials known and is used on the cutting edges of high-speed machine tools...“ (Source)

Full size / Source / “Tantalum (Ta) is an unsung hero in modern metallurgy. First discovered by the Swedish chemist Anders Ekeberg in 1802, this versatile metal has become essential to numerous industries over the years. Raw tantalum rarely occurs in nature. Instead, it is typically found in the ore columbite-tantalite (usually referred to as coltan). Once extracted, pure tantalum is a hard blue-gray lustrous metal. Since its discovery, tantalum has been used in a number of applications. In the 21st century, it has become a crucial element in the electronics industry, with over 75% of electronics containing tantalum in some form. In particular, engineers have been able to take advantage of some of tantalum’s properties to make capacitors and other components smaller and more efficient... Tantalum has several unique characteristics that have led to its increased use in the 21st century. It is a highly stable metal that is almost immune to chemical degradation at temperatures lower than 302 °F (159 °C). In addition, it exhibits high levels of corrosion resistance when it comes into contact with air and moisture. Like most metals, tantalum forms a thin but dense protective oxide layer (Ta2O5) when exposed to the atmosphere. This oxide layer firmly adheres to the surface of the metal, acting as a barrier which protects the underlying metal from further corrosion... In terms of mechanical properties, tantalum is highly ductile, making it suitable for processes such as bending, stamping, and pressing. When combined with other metals, it can produce alloys with enhanced strength and higher melting points.“ (Source)

Management & Directors

Chris Grove

Chris is an experienced resource sector professional with over 20 years in the business. He has been a Director of several other junior mineral explorers, and he has assisted in raising over $100 million for Commerce Resources Corp. since 2004. He served as President of Commerce from 2014-2024.

Dave Hodge

Dave is the founder and former CEO of Commerce Resources Corp. He led the team that IPO’d Commerce Resources, the original Blue River Project owners in 2001. Dave and Commerce raised more than $34 million towards the advancement of the Blue River Project.

Dr. Axel Hoppe, PhD. Chem

Axel is an internationally acknowledged leader in the global tantalum market. He is the former Head of Technical Services and Engineering Group for H.C. Starck, the world’s largest consumer of tantalum. Axel also served as President of the Tantalum and Niobium International Study Center for the years 2002-2007.

Justin Schroenn

Justin is another former Commerce Resources executive, having more than 8 years of experience with the Blue River Project. He has raised significant capital for both the Blue River Project and its former sister project, the Ashram Rare Earth Element Project in Quebec and is well known to both Capacitor and Commerce shareholders.

Max Lentz, MBA

Max has over 40 years background in business ownership and management. He was an Electoral Area Director for the Thompson Nicola Regional District (TNRD) representing Area “B” (Avola – Blue River). Max was also a Director for the Thompson Regional Hospital District, and the Vice Chair for the TNRD Regional Growth Strategy Committee. His major accomplishments include bringing TELUS Cell Phone towers and High-Speed Internet to Blue River and other communities.

Nate Schmidt, B.Sc., P.Geo.

Nate is a Senior Geologist at Dahrouge Geological. He has planned and managed numerous drill programs and ground geological programs for a variety of commodities across Canada, the United States and Africa. His commodity experience has been focused on metallurgical coal, cobalt, lithium, rare metals, and uranium.

Mike Hodge

Mike’s hands-on experience with the Blue River Project extends back to 1999 when he hand-staked the claims in mid-winter. He has been central to field operations on the project and relationships with the local communities ever since.

Company Details

Capacitor Metals Corp.

Suite 1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 484 2700

Email: info@capacitormetals.com

www.capacitormetals.com

Canadian Symbol: Not Listed

German Symbol / WKN: Not Listed

Contact:

www.rockstone-research.com

Disclaimer: This report, the referenced news-releases and external articles contain forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Capacitor Metals Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Capacitor Metals Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedarplus.ca. Please read the full disclaimer within the full research report as a PDF (see here or below) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds an equity position in Capacitor Metals Corp., as well as equity of Zimtu Capital Corp., and thus will profit from volume and price appreciation of those stocks (Capacitor Metals Corp. is a private company not listed on a stock exchange at this date). The author is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. holds an equity position of Capacitor Metals Corp. and thus will profit from volume and price appreciation if the featured company will be listed on a stock exchange. Note that Capacitor Metals Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services.

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and Capacitor Metals Corp. (“Capacitor“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Capacitor‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward looking include that Capacitor, or any other company or market, will perform as expected; that exploration has or will discover a mineable deposit; that Capacitor has big plans for one of the world’s biggest deposits of tantalum and niobium; that Capacitor is the one and only pure-play tantalum investment opportunity; that Capacitor is considered to be the only pure-play tantalum junior available for investment at the moment, with no other public companies known in this sector; that tantalum, the unsung hero as a technology-critical metal, is starting to make waves in the markets as investors are realizing its rapid growth in the electronics industry, particularly the increasing need for tantalum capacitors; that the artificial intelligence era would come to an abrupt end without tantalum; that most tantalum comes from artisanal and small-scale mines, where alluvial deposits have been heavily depleted after decades of surface mining; that alarmingly, the industry is quietly but urgently seeking a stable and reliable source of tantalum capable of delivering substantial and consistent production for decades; that this pressing need is the driving force behind the formation of Capacitor Metals Corp., with the Blue River Tantalum-Niobium Project emerging as the leading development initiative in the Western World; that Capacitor’s Blue River Project is the world‘s largest and most cost-effective potential near-term supplier of conflict-free tantalum, historically boasting the largest cash-positive production scenario for tantalum worldwide; that Capacitor has an intent to go public; that Dave Hodge is pleased to have Chris Grove take the reins as Capacitor moves this project forward to success; that Capacitor has assembled a very impressive team heading into the future; that this significant resource has received an increase of interest recently due to the fundamental shift in global supply and demand, and we look forward to releasing more details on developments for the Upper Fir Deposit; that Commerce Resources Corp. plans to distribute all 20 million Capacitor shares to its shareholders on a pro rata basis at a later date, and that holding shares of Commerce Resources could prove to be very advantageous; that additionally, there may be further benefits in participating in the private placement financing that Capacitor announced today; that Capacitor intends to finance the ongoing exploration and marketing of the Blue River Project with a five-cent private placement unit for up to $2 million; that this financing will facilitate an updated NI 43-101 Technical Report and a new strategic plan to move the company forward; that the financing will rely on exciting exceptions and preference will be given to shareholders of Commerce Resources Corp. and Zimtu Capital Corp., as well as subscribers of Rockstone Research; that with this rare opportunity, investors can participate in the development of the advanced-stage Blue River Project by way of investing early in a private company with intent to go public; that today, tantalum is back on the radar of investors as the market is facing a supply shortage due to strong demand growth; that a new NI 43-101 Technical Report expected shortly (one of the requirements for seeking a public listing on a Canadian stock exchange); that Commerce Resources believes that the Blue River claims will be effectively stewarded by the management of Capacitor; that the Blue River Project is one of the world‘s leading ESG-focused tantalum and niobium projects; that the PEA completed on the Upper Fir Deposit, defining a low capital expenditure project that could produce 700,000 lbs Ta2O5 annually, outlining its potential to be the world’s largest tantalum producer (2,500 t per day from one portal; mine life >30 years with current resource); that the PEA defines Blue River as a potential large-scale, low-cost producer of conflict-free tantalum, as well as significant niobium; that there exists expansion potential to Upper Fir, Fir and additional deposits, providing further production upside; that the Upper Fir Deposit has a significant Indicated Resource of 9.6 million kg contained tantalum and 77.8 million kg contained niobium plus Inferred Resources of 1 million kg contained tantalum and 9.6 million kg contained niobium; that there are minimal infrastructure needs – rail, paved road, water and power adjacent to project site; that estimated overall final recovery rates increased to 77.2% for tantalum and 75.1% for niobium (2013) against PEA base case of 65-70%; that as the demand for smaller, more powerful electronics continues to grow, tantalum pentoxide will remain a crucial player in the ever-shrinking world of electronic components; that the global capacitor market was estimated at a value of US$ 31.7 billion in 2021, and that it is anticipated to register a 6.4% CAGR from 2022 to 2031 and by 2031, the market is likely to attain US$ 58.67 billion; that one of the key reasons that is anticipated to propel the capacitor market in the coming years is the growing demand for capacitors from the consumer electronics industry; that global tantalum mine production is highly concentrated, creating a substantial risk of supply disruptions; that tantalum production from the Great Lakes region has been falling over recent years due to the fact that production predominately takes place in an artisanal and small-scale mining setting with alluvial deposits increasingly depleting after decades of exploitation; that only few pegmatites in the Great Lakes region show potential for development as industrial mines as the mineralized dikes/sills must be thick or long, or must have accumulations of a large number of dikes/sills, in order to warrant building a mine including a processing facility. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include: Capacitor‘s securities will not get listed on a stock-exchange which means that shareholders may not be able to trade; the agreement between the vendors and Capacitor will not be completed or fulfilled; the receipt of all necessary approvals and permits for a stock exchange listing, property agreement, exploration and mining; the ability to find sufficient mineralization to mine; uncertainty of future production, uncertain capital expenditures and other costs; financing and additional capital requirements for exploration, development and construction of a mine may not be available at reasonable cost or at all; mineral grades and quantities on the projects may not be as high as expected; samples found to date and historical drilling may not be indicative of any further potential on the properties; that mineralization encountered with sampling and drilling will be uneconomic; that the targeted prospects can not be reached; the receipt in a timely fashion of further permitting; legislative, political, social or economic developments in the jurisdictions in which Capacitor carries on business may hinder progress; there may be no agreement with neighbors, partners or government on developing the respective projects or infrastructure; operating or technical difficulties or cost increases in connection with exploration and mining or development activities; the ability to keep key employees and operations financed; what appear at first to be similarities with operating mines and projects may not be substantially similar; share prices and market valuations of Capacitor and other companies may fall as a result of many factors, including those listed here and others listed in the companies’ disclosure; and the resource prices available when the resource is mined may not be sufficient to mine economically. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. Note that mineral grades and mineralization described in similar rocks and deposits on other properties are not representative of the mineralization on Capacitor’s properties, and historical work and activities on its properties have not been verified and should not be relied upon. Mineralization outside of Capacitor’s projects is no guarantee for mineralization on the properties from Capacitor, and all of Capacitor’s projects are exploration projects. The historical information on the Blue River Property is relevant only as an indication that some mineralization occurs on the property, and no resources, reserve or estimate is inferred. A qualified person has not done sufficient work to classify the historical information as current mineral resources or mineral reserves; and neither Rockstone nor Capacitor is treating the historical information as current mineral resources or mineral reserves. Also note that surface sampling does not necessarily correlate to grades that might be found in drilling but solely shows the potential for minerals to be found at depth through drilling below the surface sampling anomalies. Any disposition of the Blue River Shares will, if undertaken, be conducted in compliance with applicable corporate and securities laws, and the policies of the TSX Venture Exchange. Completion of the Blue River Transaction is subject to the conditions set forth in the Purchase Agreement, including, if required, acceptance by the TSX Venture Exchange. As per Capacitor’s news-release on June 17, 2024: “Forward Looking Statements: This news release contains forward-looking statements, which includes any information about activities, events or developments that the Company believes, expects or anticipates will or may occur in the future. Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include that the Company is specifically focused on the development of its Blue River tantalum and niobium deposit in British Columbia, It is important to note that actual outcomes and the Company’s actual results could differ materially from those in such forward-looking statements. Risks and uncertainties include economic, competitive, governmental, environmental, and technological factors that may affect the Company’s operations, markets, products, and prices. Factors that could cause actual results to differ materially may include misinterpretation of data; that we may not be able to get equipment or labour as we need it; that we may not be able to raise sufficient funds to complete our intended exploration and development; that our applications to drill may be denied; that weather, logistical problems or hazards may prevent us from exploration; that equipment may not work as well as expected; that analysis of data may not be possible accurately and at depth; that results which we or others have found in any particular location are not necessarily indicative of larger areas of our properties; that we may not complete environmental programs in a timely manner or at all; that market prices for tantalum & niobium may not justify commercial production costs; and that despite encouraging data there may be no commercially exploitable mineralization on our properties.” As per Capacitor’s news-release on August 29, 2024: “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release may contain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Forward-looking statements in this news release include statements with respect to the Offering including, the closing date of the Offering, the potential participation of insiders in the Offering and the anticipated use of proceeds of the Offering. Forward-looking statements are subject to various known and unknown risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements, including risks related to factors beyond the control of the Company, including, but not limited to, the receipt of regulatory approval for the Offering, if required. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.”

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known, or if the company is private and not listed on a stock exchange with an intent to go public. The author of this report, Stephan Bogner, is paid by Zimtu Capital, a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu Capital is to research and report on companies in which Zimtu Capital has an investment. So while the author of this report is not paid directly by Capacitor Metals Corp. (“Capacitor“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of Capacitor’s stock prices if the company is successful in obtaining a listing on a stock exchange. The author also owns equity of Capacitor, as well as an equity position in Zimtu Capital Corp., and thus will also benefit from volume and price appreciation of those stocks if the company is successful in obtaining a listing on a stock exchange. Capacitor pays Zimtu Capital to provide this report and other services. As per news-release on June 17, 2024: “Zimtu Capital Corp. (TSX.V:ZC)(FSE:ZCT1) (the “Company” or “Zimtu”) announces it has signed an agreement with Capacitor Metals Corp. (“Capacitor”) to provide its management & services program. Zimtu will receive $150,000 from the company for the duration of the one-year contract. Zimtu’s management & services agreement includes office space, accounting services & management consulting services, including guiding the company through its fundraising activities and it’s progression as a private company.” Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Capacitor and the public domain.