Disseminated on behalf of Homerun Resources Inc. and Zimtu Capital Corp.

Did you know that the global daily demand for sand is around 18 kg per person on average? That‘s about 6,570 kg per year – more than an elephant’s weight in sand. This makes sand the world‘s most mined material, with some 50 billion tonnes extracted every year. As you know, sand comes in many colors. Impurities like iron give it a yellowish tint. When the quartz grains are almost pure and not much mixed with other particles, we get white-colored sand. And that‘s the type of rare sand the world needs to make the energy transition a success. It‘s called high-purity (quartz) silica sand and is used for the production of solar panels, wind turbine blades and many other high-tech products like smartphones, TV screens and fibre optics. Alarmingly, we are running out of high-purity silica sand.

Last month, Homerun Resources Inc. executed a Letter of Intent (LOI) for a Material Supply Agreement concerning the supply of silica sand from an operating mine in Brazil. The purchase price is set at $20 USD per tonne net of recoverable costs, sales taxes and export taxes. Most interestingly, the vendor has provided extensive third-party testing that verifies and demonstrates that the raw silica sand grade averages +99.8% SiO2 and, importantly, “contains very low levels of impurities“. For raw/unprocessed silica sand, this is very high-grade material.

The Guinness Book of Records lists Australia as home of the world‘s whitest sand beaches. Aside from that, most publicly traded companies with a focus on high-purity silica sand deposits are listed on the ASX, with its projects located predominantly at or near the coastline of Queensland and Western Australia.

What strikes the eye is that the resource grades of most Australian silica sand projects are lower than Homerun‘s Brazilian source. While Australian silica sand development projects face mine permitting challenges, Homerun is taking the fast lane by securing supply from an operating mine at highly competitive prices. Brazil is one of the world‘s leading solar and wind power generating countries, facilitating the establishment of a domestic supply chain to manufacture green technologies and its components, such as solar cells and solar glass, to profit from cheap renewable energy.

Full size / Source / According to Mitsubishi, owner and operator of the Cape Flattery Silica Mine (CFSM) in Queensland, Australia: “Silica sand has long been used to make a variety of products, including construction materials and the glass for vehicle windscreens. In recent years, it has also been used to manufacture solar panels, and with interest in renewable energies now on the rise, its demand is taking off. CFSM is known for producing a particularly high grade of silica sand, and in terms of global supply stability, the company is in a league of its own. The Cape Flattery mine is among the world‘s largest, and the quality of its silica is exceptional.“ (Source) After processing (extensive washing and filtering) on site at the CFSM, the silica sand reaches a purity of 99.93% SiO2, 100 ppm Fe, 200 ppm Ti and 300 ppm Al and is exported to Asia. As Homerun‘s raw silica sand grade averages 99.8% SiO2, physical/mechanical and/or chemical processing may increase the grade even further.

Homerun‘s CEO, Brian Leeners, commented in the news-release on May 23, 2023: “This Supply Agreement is part of the Company‘s plan to build a globally distributed book of high-purity quartz (HPQ) silica sand supply. By accessing a reliable and abundant source of high purity quartz, we can ensure a stable supply chain and secure a competitive advantage in meeting the increasing global market demands. The Company‘s plan is to procure HPQ silica through company-owned resources, joint ventures and other collaborations, including open market purchases. The Company is currently in discussions with several additional current and future HPQ silica producers to build regional supply for the Company‘s global initiatives.“

In a recent interview, Brian stated that the company is working to turn the cash from the last financing into revenue as quickly as possible. He also said that moving a resource project from early-stage to development-stage and then mine-stage takes a lot of time. Homerun has taken a different approach by securing high-quality product from an operating silica sand mine for the purpose of finding and supplying customers.

Although the average grade of Homerun‘s Brazilian silica sand source (+99.8% SiO2) is already exceptionally high, the company mentioned its plans to initiate testing on the reduction of the remaining impurities by applying advanced chemicals and thermal processing (through a combination of calcination and acid leaching). Also, the applicability of the material for solar glass will be assessed by laboratory melting tests.

On May 31, Homerun announced the “key appointment“ of Antonio Vitor to the newly created role of Country Manager, Brazil, with Brian stating: “This position was created to provide executive oversight of the Company‘s expanding Brazilian operations. Antonio will be a valued addition to the existing leadership team and will be responsible for managing Homerun‘s operations and focused on achieving our plans for growth in Brazil. Antonio‘s career expertise and background in operational management and business development in the resource sector will contribute significantly to Homerun‘s strategic objectives in Brazil and we are excited to welcome Antonio to the Homerun team.“

In a recent interview, Brian stated that Antonio has extensive resource sector experience in Brazil and is very networked into business and resource development departments at both the state and federal levels of government. He also has strong relationships within the capital and banking sector, in particular in Sao Paulo. In an earlier interview, Brian explained the strategic importance of silica sand for the energy transition and that it‘s actually more important than lithium.

The outbreak of the COVID-19 pandemic greatly affected economic development globally. The construction industry along with the oil and gas industry were severely affected. As a result, many sand miners with products for both these industries suffered, first and foremost publicly listed frac sand companies. In contrast, many silica sand stocks targeting the (solar) glass industry appreciated strongly since early 2020, such as U.S. Silica Holdings Inc. (+1366%), Canadian Premium Sand Inc. (+420%), Metallica Minerals Ltd. (+238%) and Diatreme Resources Ltd. (+144%).

“We give such little thought to sand… but sand and gravel build the foundations of our economies.“ (United Nations Report on Sand and Sustainability, 2019)

About 95% of the Earth‘s crust is composed of silicate minerals, making silicon (Si) the second-most abundant element in the Earth‘s crust (about 28% by mass) after oxygen, with which it is always associated in nature.

Silicon is the 8th most common element in the universe by mass, but very rarely occurs as the pure element in the Earth‘s crust due to its high chemical affinity to oxygen, forming silicon dioxide (SiO2, also called silica). It is relatively unreactive and has the second highest melting (1414°C) and boiling (3265°C) points among all the metalloids and non-metals, being surpassed only by boron.

“It seems like the most boring thing in the world. But come to find out it’s actually the most important solid substance on Earth. Without sand, we have no modern civilization. And the craziest thing about it is: We are starting to run out.” (Vince Beiser in “The World in a Grain: The Story of Sand and How It Transformed Civilization“)

The late 20th century to early 21st century has been described as the Silicon Age (also known as the Digital Age or Information Age) because of the large impact elemental silicon has on the modern world economy (similar to the Stone Age, Bronze Age and Iron Age defined by the dominant materials during their respective ages of civilization).

The most common constituent of sand is silica, usually in the form of quartz, which – because of its chemical inertness and considerable hardness – is the most common mineral resistant to weathering.

Sand is the world’s second-most consumed resource after water. The little grains of silica have become an increasingly strategic material as one of the world‘s most important but least appreciated commodities.

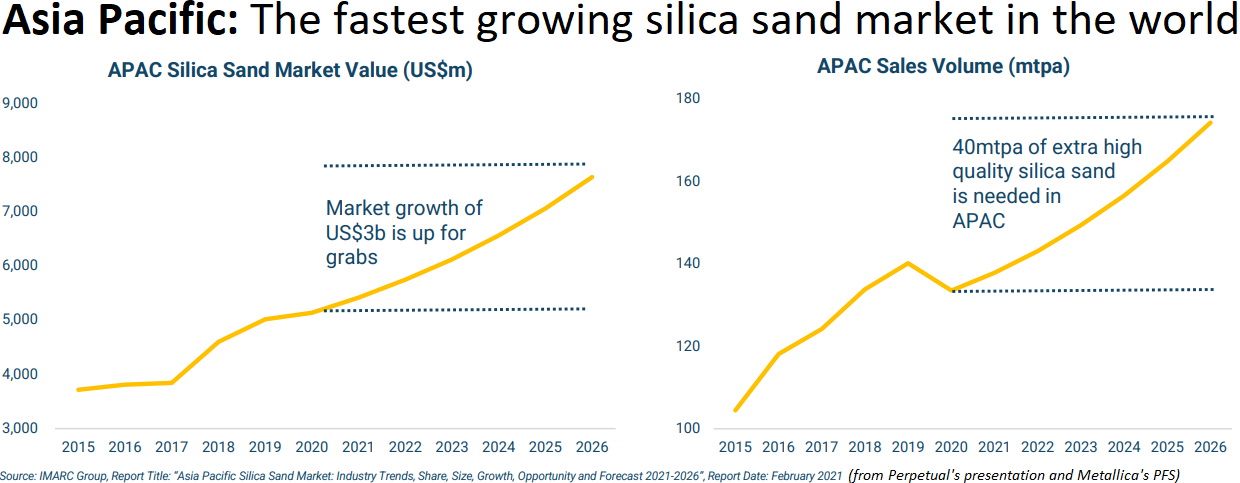

Although the use of sand in the developing world is voracious, it is not traded on any exchange and the global sand market lacks transparency with no central market due to localised supply-demand relationships. As there are only few publications of market fundamentals, such as supply and demand figures along with prices in the usual sense, the sand market traditionally lacks broad investors‘ interest. This has changed with the energy transition, where silica sand is critically important, and with Australia developing silica sand mining projects owned by companies publicly traded on the Australian Stock Exchange. This has led to an increasing number of investors gaining exposure to this strategic commodity in high demand, offering high profit margins.

“Our entire society is built on sand“, CNBC contemplated in 2021. “Sand is the primary substance used in the construction of roads, bridges, high-speed trains and even land regeneration projects. Sand, gravel and rock crushed together are melted down to make the glass used in every window, computer screen and smart phone. Even the production of silicon chips uses sand. Yet, the world is facing a shortage...“

The UN describes sand as “the elephant in the room“ and estimates that the world uses 50 billion tonnes of sand and gravel each year, enough to build a wall 27 metres wide and 27 metres high around the planet. To put this in context, this is more than 10 times the movement of coal, the next-highest bulk commodity traded on a global scale, followed by iron ore and grains.

Most sand is used for land reclamation and island building (~28 billion tonnes per year, followed by the manufacture of concrete (~12 billion tonnes per year). To manufacture glass, the world consumes about 300-350 million tonnes of silica sand annually. This includes glass for architecture (e.g. windows), containers (e.g. bottles) and electronics (e.g. smartphones, TV screens).

“And where is the problem with that“, BBC asked in 2019. “Our planet is covered in it. Huge deserts from the Sahara to Arizona have billowing dunes of the stuff. Beaches on coastlines around the world are lined with sand. We can even buy bags of it at our local hardware shop for a fistful of small change... How can we possibly be running low on a substance found in virtually every country on earth and that seems essentially limitless?“

It‘s because not all sand has been created equal.

For example, desert sand – eroded and shaped by wind – is largely useless to us because the grains are too smooth and rounded to lock together to form stable concrete. “There is so much demand for certain types of construction sand that Dubai, which sits on the edge of an enormous desert, imports sand from Australia“, BBC noted in its article “Why the world is running out of sand“. Nearly all the sand used in making concrete in southeast Asia is imported.

High-purity silica sand is needed for container glass, speciality high-tech glass, foundries, ceramics, cosmetics, paint and coatings, metallurgy, chemicals production, oil and gas recovery, water filtration and construction. There is silica sand in your mobile phone, within silicon chips, and in lithium-ion batteries, as well as solar cells.

Full size / Source / To produce solar cells, ultra-high-grade silica sand (usually in the form of crushed quartz rock) is purified by chemical processing and then melted in a crucible, which also contains silica sand, to form a silicon ingot.

Full size / Source / To produce solar glass (covering the solar cells), Fe2O3 in silica sand is reduced to less than 90 ppm by physical and/or chemical processing to meet the quality requirements of photovoltaic glass raw materials. Ultra white glass requires Fe2O3 <0.009% in its composition, which has high light transmittance. The light transmittance determines the quality of glass. The light transmittance of float glass is 86%, and the light transmittance of ultra white glass is more than 92%. The production of ultra white glass requires very strict quartz sand, SiO2 >99.6%, Fe2O3 <0.005-0.001%, otherwise the quality of ultra white glass cannot be guaranteed. With the development of photovoltaic power generation, the demand for ultra white glass has multiplied, and the demand for high-purity and low-iron quartz sand has also increased.

When it comes to high-tech glass used in solar panels, smartphones and TV screens, the sand must have a high purity exceeding 99.5% SiO2 and impurities (first and foremost iron) must be low, otherwise the glass would not be clear, losing efficiency to transmit light. However, high-purity silica sand deposits are exceedingly rare globally. Silica sand is everywhere, but there is a global imbalance as to where the high-grade silica is found in the natural environment.

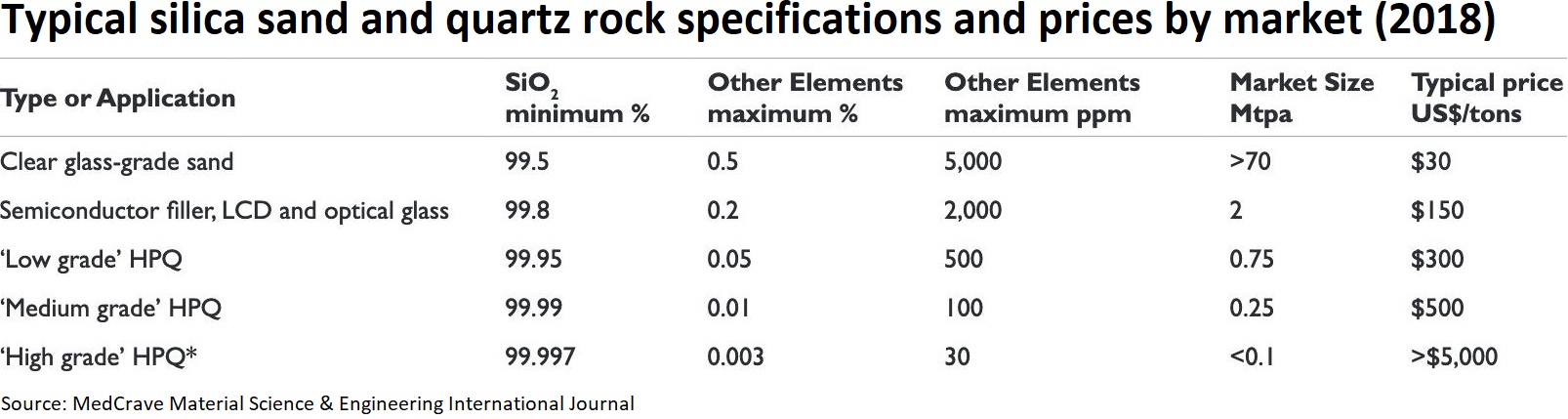

As a result, the price of sand varies depending upon quality. Lower grade sand is usually called regular sand or construction sand. The world consumes about 300-350 million tonnes of high-purity silica sand annually for the manufacture of glass, which is only 0.6% of the total sand market estimated at 50 million tonnes per year. And the higher the purity goes up from 95%, the less sand is available. Consequently, the highest purity silica sands make the highest prices.

The looming shortage of the highest quality silica sand is different from the shortage of construction sand as it involves high-tech industries (e.g. fibre optics, LCD panels, microelectronics, and other electronic uses such as Corning’s gorilla glass® in smartphones) and, even more critically, industries involved in the energy transition (e.g. solar glass which comprises 50% of the mass of a solar panel, and wind turbine blades which comprise 50% of glass fibres).

Virtually all publicly traded silica sand companies target the smallest sand market, the specialized glass manufacturing industry, first and foremost solar glass. That‘s only because this industry pays much higher prices.

Full size / Solar glass: The above cover-glass for PV modules and solar thermal collectors was processed to “extra clear (low-iron) float glass“. (Source: AGC Solar Glass, Belgium)

High-purity silica sand is a premium quality industrial sand that is used in various applications such as glass making, foundries, hydraulic fracturing, and construction. It is a type of silica sand that has a very low level of impurities and is usually white or light-colored. The high-purity silica sand price can vary depending on several factors such as the grade of the sand, the location of the supplier, the quantity purchased, and the current market conditions.

Australia, the United States and Canada have one of the world‘s greatest abundances of silica sand deposits. In the US and Canada, however, many deposits have too many impurities and are, at best, suitable as frac sand for the oil and gas industry, where impurities do not matter as much as in the glass industry. A great deal of frac sand falls within the range of 95-99% SiO2 and must meet strict characteristics of shape, size, and strength. As an exception, the Spruce Pine Mining District in North Carolina‘s Appalachian Mountains is “the source of the purest natural quartz ever found on Earth“. This “ultra-elite deposit“ of hard-rock pegmatites hosts about 25% quartz almost without impurities, along with 65% feldspar, 8% mica and traces of other minerals. The quartz from this deposit, after a series of complex chemical processes, is utilized in the creation of silicon metal (polysilicon), which is the base for wafers used in solar cells and computer chips.

The manufacturing process for solar cells and computer chips typically requires silica sourced from quartz rock/crystals, because most high-purity silica sands still have too many impurities, even after processing. Therefore, most silica sand is, at best, suitable for the glass sheets that protect the cells (“solar glass“).

However, when looking at the specifications for solar glass (≤70 ppm iron; some other sources state ≤120 ppm iron as maximum), it strikes the eye that many Australian silica sand projects hardly fulfill this criteria (even after processing). As such, these silica sand resources may only qualify for speciality or container glass, and for the foundry or ceramics industries, unless these companies can improve its metallurgical processing methods. Iron occurring as coatings on the sand grains or as inclusions may prove difficult to remove in processing whereas iron in aluminosilicate clays is more readily removed. Many Australian silica sand projects are facing permitting issues as the deposits typically occur near rivers or coastlines. If impurities in the sand and overlying layers are elevated, environmental damage is possible to affect large water areas. Heavy metals, such as iron, are of particular concern (acid drainage).

Silica sand deposits are most often surface-mined in open-pit operations but dredging and underground mining are also used. For industrial applications, deposits of silica yielding products of at least 95% SiO2 are preferred. The production of such high-purity sand oftentimes requires that the extracted raw sands undergo processing to reduce impurities through the flotation of gangue minerals such as iron, aluminum, magnesium and titanium. The sand is then dried and sized to the optimum particle size distribution depending on the targeted application.

Silica sand is increasingly used in the manufacture of solar panels and wind turbine components, yet it‘s also showing promise as an inexpensive medium for long-term thermal storage of renewable energies as it naturally withstands super-hot temperatures. Is the world future energy “made of“ sand?

Full size / “Between 2000 and 2010, solar production grew by a factor of 20. The following decade, growth accelerated even more; between 2010 and 2020, production grew by a factor of 35. Over the last ten years solar has grown by an average of 30% per year.“ (Source)

“I’d put my money on the sun and solar energy. What a source of power! I hope we don’t have to wait until oil and coal run out before we tackle that.” (Thomas Edison in 1931)

The global solar glass market was valued at around $15 billion USD in 2021 and is expected to reach $124 billion USD by 2029, growing at a CAGR of 30.72% during the forecast period, according to Maximize Market Research (2023). “Global solar PV manufacturing capacity has progressively moved from the US, Europe, and Japan to China over the last decade. Ten times more than Europe, China has invested over USD 50 billion in new PV supply capacity. China now accounts for more than 80% of all solar panel manufacturing processes. This is more than twice China‘s proportion of the world‘s PV demand. In addition, the country is home to 10 of the world‘s top providers of machinery for making solar PV. China has played a significant role in lowering solar PV costs globally, which has many benefits for the transition to sustainable energy. However, the degree of geographic concentration in global supply chains also increases possible issues and same are analyzed in the report by region.“

Full size / “The solar industry is growing super fast. The median module maker is expected to boost sales more than 25% this year, according to consensus. This compares with demand growth of 36% according to BloombergNEF (keep in mind falling module prices).“ (Source)

Excerpts from “Brazil hits 30 GW milestone“ (June 2023): “Brazil reached 30 GW of installed solar power, according to new data from the country‘s energy regulator Aneel. Of this capacity, around 15 GW was deployed in the last 17 months... In centralized generation, there are more than 102 GW of awarded projects still under construction or under development... Larger projects are expected to support the growth of the free market and supply power for the energy-intensive production of green hydrogen.“

Excerpts from “Made in Brazil solar“ (September 2022): ”Sengi Solar, a PV module manufacturer, said in early September that it plans to invest BRL 440 million ($85 million) to set up two solar panel factories in Brazil. The two sites will have an annual production capacity of around 1 GW of modules. The first unit, in Cascavel (Paraná), is already in operation. The second unit, in Ipojuca (Pernambuco), is scheduled to start operations in the first half of 2023. The Brazilian company told pv magazine that it plans to open a third factory in 2024, to reach of 1.5 GW of annual production. At the moment, the factories are focusing on module assembly, with cells imported from China... The company says it wants “100% autonomy” in the potential cell factory. It has pointed to the mining of quartz in Brazilian states such as Minas Gerais as a way to eventually stop buying wafers from China. “Who knows? Maybe in 10 years we will have the whole supply chain, from quartz, silicon metal, solar silicon, ingots, wafers and cells here in Brazil,” said Murilo Bonetto, R&D manager at Sengi Solar. “What we are seeing is a cyclical process of re-industrialization in Brazil, in which we invest in photovoltaic module manufacturing, this increases the output volume, which in turn makes raw material factories viable, which then increase the volume of module manufacturing.”

Full size / IMARC Group estimated the global silica sand market could grow from $7 billion USD to $20 billion in 2024, with strong demand for processed high-purity silica (>99.9% SiOâ‚‚) with low iron (100 ppm) for high-tech products. (Source: Metallica Resources‘ PFS, 2022)

Full size / The Asian demand for imported silica sand over the past 5 years has a CAGR of 9.1% by volume, with main buyers continuing to be China, Japan, Taiwan and South Korea. Total volume to be taken up by these main buyers for the full 2021 year is estimated to be 6.7 million t. China will take up 52.3% of the demand volume in 2021... Demand is estimated to reach 12.7 million t by the end 2024. This demand will continue to be largely driven by China. China maintains a massive scale advantage in solar panel manufacture. In 2020, the top five Chinese solar glass producers had a 68.5% share of the global market’s capacity. In terms of how much glass goes into the production of a solar panel, assuming 3 mm glass, 96% of the weight of a thin-film module and 67% of a crystalline module is glass. The cost structure of solar glass is mostly split between soda ash and quartzite ore estimated as 37-41%, and power 40-41%. Technology advancement in bi-facial solar cells – estimated to account for 40% of all production by 2025, looks to further underpin the demand for PV glass and suitable high-grade silica sand. (Source: Metallica Resources‘ PFS, 2022)

Excerpts from Global Wind Report 2023: “Many other major economies, including [...] Brazil already have – or are in the process of designing – measures to ensure high levels of local content in their wind energy sectors... As we have seen in places as diverse as the UK, the US, Brazil and Denmark, local manufacturing and employment eventually translates into long-term, bipartisan support for the wind industry, and creates a virtuous circle of growth, investment and higher political ambition for the sector... LATAM has no offshore nacelle assembly facilities despite Chinese turbine OEM Mingyang looking for offshore wind investment opportunities in Brazil since 2020... With a new government in place, Brazil is making great strides in establishing an offshore wind industry... Newly elected President Luiz Inácio ‘Lula’ da Silva said during his electoral campaign that his government would place climate change and the energy transition at the core of its policies, and some concrete signs in this direction have already been sent. Brazil’s new federal administration is expected to provide incentives for the energy transition while balancing energy sector priorities with a broad environmental agenda. This represents a crucial strategic opportunity for the country... Official data confirmed that wind energy sits in second place behind hydro by share of electricity generation in Brazil, while also providing an impressive list of socioeconomic benefits.“

Full size / “GWEC Market Intelligence expects that new wind power installations will exceed 100 GW in 2023 and that 680 GW of new capacity will be added in the next five years under current policies. This equals more than 136 GW of new installations per year until 2027. The compound annual growth rate (CAGR) for the next five years is 15%... Brazil will continue to establish itself as a wind energy powerhouse... the Brazilian wind energy sector gains resilience and prepares for a very bright future.“ (Source)

Foreword to the Global Wind Report 2023 by Elbia Gannoum, President of ABEEólica, Brazil’s wind energy and new technologies association, and GWEC Vice Chair:

“Brazil’s wind power revolution: In Brazil, we are living in a time of great excitement and renewed hope in our potential and in the future. The new government of President Luiz Inácio ‘Lula’ da Silva is resuming work on key issues that were abandoned in recent years, such as the fight against climate change, protection of the environment – especially the Amazon – and the reduction of social inequalities. These are matters dear to the wind sector, which positively impacts society from an environmental, social and economic point of view. The Brazilian wind power revolution has been under way for some years now. The industry achieved 25.6 GW of installed capacity in 2022, with wind energy now holding a firm position as one of Brazil’s strongest energy generation sectors. In addition to the continued growth of onshore wind, we have great expectations for the development of Brazilian offshore wind. IBAMA, the Brazilian Institute for the Environment and Renewable Natural Resources, has already received project proposals for more than 170 GW of offshore wind energy. This number is equivalent to practically the entire Brazilian electricity matrix and shows the extent of investor appetite and the enormous potential for offshore wind in Brazilian waters. There is not enough demand for that amount of electricity, however. That’s where green hydrogen comes into play. Coupling this technology with the enormous potential for offshore wind could consolidate Brazil’s standing as a renewable energy superpower building on its already advanced wind energy supply chain and wider industrial and maritime capabilities. The renewable resources available in Brazil, especially its abundance of quality wind both onshore and offshore, are certainly unique in the world. This opens a window of opportunity for the production of green hydrogen, which would have the capacity not only to revolutionise Brazil’s energy matrix – already one of the most renewable in the world – but also to export green hydrogen to other countries that may not be able to produce all the renewable energy they will need to meet their energy transition goals. Brazilian companies and state governments have taken important steps towards the creation of a green hydrogen sector for the country, including agreements to invest more than 200 billion USD. In January, EDP produced its first green hydrogen molecule in Brazil and Unigel will have its first hydrogen and green ammonia production plant in commercial operation by the end of 2023. From 2050, according to the consultancy Roland Berger, Brazil could derive annual revenues of 150 billion BRL from green hydrogen, of which 100 billion BRL would come from exports alone. What we are seeing, therefore, is an industry that is already here and ready to grow rapidly, especially considering the opportunities for domestic demand. Currently, Brazil uses fossil-fuel hydrogen in its fertiliser, refining, chemical, food and metallurgy industries. Replacing this with green hydrogen would allow decarbonisation and net zero in many Brazilian industry sectors to become a reality. We know this is a long road, but we are also certain that we are on the right track. The Brazilian wind energy revolution is already here for all to see – and will continue to gain strength. It is just a matter of time and dedicated work by the government, investors, companies and professionals in the sector. Let’s all work together to continue putting the wind in Brazil’s sails.“

Management

Brian Leeners (CEO & Director)

Brian received both his Bachelor of Commerce and Bachelor of Law degrees from the University of British Columbia in 1992. Since then, he has been focused on the management of private and public companies. In 2002, he founded Nexvu Capital Corp., a venture capital firm focused on developing companies in the materials and technology sectors. During the last resource cycle, Nexvu Capital focused on four copper projects, of which three were sold for profits and one (a targeted copper porphyry) is now under an exploration JV with the Friedland Group.

Antonio Vitor (Country Manager Brazil)

Antionio has vast experience in project management at large corporations, including Transpetro, PwC, Shell, along with 10 years of experience in mining. He was involved in the mining projects Zumbi Mineração Grafite de veio, AMA Gold, Hawking Graphite, 3 S Rare Earths and Copper, Palmeres Rare Earths. He graduated in Business Administration and holds an MBA. He is a Member of IBGC.

Carlos Bastos (Geologist, QP Brazil)

Carlos has 37 years of experience as a geologist working in Brazil. He was the Technical responsible for Vale‘s largest kaolin project in Pará, as well as bauxite. He worked in project management and geology positions at CODELCO, Alcoa, Vale and Ferbasa. He has also consulted on research reports and measurement of recesses in multiple projects in Brazil. He graduated as Geologist from the Federal University of Rio de Janeiro and holds a Master´s degree from the Federal University of Pará. He is registered as a Qualified Person at CBRR in Brazil.

Hugh Callaghan (Director)

Hugh spent several years with Rio Tinto and Xstrata in corporate management roles that included assignments at Escondida, Kennecott Copper, and Mount Isa operations. He subsequently founded or managed a number of junior companies with assets in Latin America, and has built mines in Chile and Mexico. Hugh is currently Chief Operating Officer of ASX-listed EV Resources Ltd. which is invested in copper projects in Peru. He has a lengthy track record of corporate management that includes expertise in business development, marketing and logistics, and project development.

Alastair Neill (Business Development / Materials Consultant)

Alastair is the President of Trinity Management, a consulting firm with more than 25 years of experience, specializing in business development and commercialization of technologies and specialty materials. He brings valuable expertise in international markets and business relations in Asia, North America and Europe, particularly in strategic metals and critical materials. He graduated in Materials Science Engineering from the University of Western Ontario and holds an MBA from the York University.

Greg Pearson (Corporate Development)

Greg has over 30 years of experience in the private and public sector capital markets, during which time he has been directly responsible for over $100 million in financings.

Full size / Source / The difference between clear glass (left) and low-iron glass (right): “Low-iron glass is a type of high-clarity glass that is made from silica with very low amounts of iron. Low-iron glass typically has a ferric oxide content of about 0.01%. Ordinary plate glass has about 10 times as much iron content. Low iron glass is widely used in solar panels.“ (Source) “The difference between clear and low-iron glass is the greater transparency of the latter, making it more suitable for certain uses... Clear Glass: It’s a common misconception that clear glass is the most transparent, however, this actually is not the case. Although clear glass does not have substantially high iron content, it does have more than low-iron glass. These higher levels produce a greenish tint, gaining prominence as the glass thickens. This is a result of the natural presence of iron oxide from elements such as sand, or from the cask or container whereby the glass was melted. This can cause issues within certain applications and uses. Low-Iron Glass: While clear glass is appropriate for projects not requiring high-level displays or added decorative elements, low-iron glass is likely the better choice for markerboards, frameless glass walls, UV-bonded display cases, shelving, and glass dividers. Float glass manufacturers create low-iron glass, also known as extra-clear glass or optically clear glass, by reducing the amount of iron in the molten glass formula. This is more transparent than regular glass, and doesn‘t have that aforementioned greenish tint. In fact, modifying iron content can increase the light transparency by 5 percent to 6 percent. Since the edgework of low-iron glass is less green than clear glass, it‘s not just suited for color matching – it is also appropriate for retail display cases and shelves – leading to opportunities for potential conversion through compelling product displays. Because of higher transparency and opacity levels, consumers can view merchandise without the interference of green tint.“ (Source: Dillmeier Glass Company, USA)

Company Details

Homerun Resources Inc.

#2110 - 650 West Georgia Street

Vancouver, BC, V6B 4N7 Canada

Phone: +1 844 727 5631

Email: info@homerunresources.com

www.homerunresources.com

ISIN: CA43758P1080 / CUSIP: 43758P

Shares Issued & Outstanding: 46,284,525

Canadian Symbol (TSX.V): HMR

Current Price: $0.38 CAD (06/12/2023)

Market Capitalization: $18 Million CAD

German Ticker / WKN: 5ZE / A3CYRW

Current Price: €0.253 EUR (06/12/2023)

Market Capitalization: €12 Million EUR

Contact:

www.rockstone-research.com

Disclaimer: This report, the video interviews and the referenced news-releases contain forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Homerun Resources Inc. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Homerun Resources Inc.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, owns an equity position in Homerun Resources Inc., and also owns equity of Zimtu Capital Corp., and thus will profit from volume and price appreciation of those stocks. The author is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. also holds an equity position in Homerun Resources Inc. and thus will also profit from volume and price appreciation. Note that Homerun Resources Inc. pays Zimtu Capital Corp. to provide this report and other investor awareness services. The cover picture (amended) has been obtained and licenced from Pavel_Klimenko.