Picture above: Chris Berry was a featured presenter at the Zimtu Roadtrip 2015 providing macroeconomic insight (picture from Zurich)

Picture below: Chris Berry in front of the world´s largest silver coin (1,750 ounces / 54.4 kg) displayed at the Edelmetallmesse Munich/Germany

Ed. Note: The following remarks were those I made to investor audiences during a recent bus tour in Munich, Geneva, Zurich, and Frankfurt.

Ladies and Gentlemen, thank you for coming today and investing your most valuable asset in us, which is of course, your time. Speaking of time, what I’d like to do today is take a look back and a look forward and briefly offer some thoughts on where we’ve been in the global economy in the past year and what some of the key questions are in 2016 likely to drive the commodity and broader markets altogether.

Rather than make excuses or guesses as to why commodities continue to under perform, I’d like to examine some of our thoughts from a year ago when we were last here in Europe and see what has transpired.

First, we were calling for continued disinflationary forces to predominate in the global economy which were likely to continue to put pressure on growth prospects. Unfortunately, this seems to have been correct as almost any economic data one can examine today points more towards deflation and less so towards inflation. To be clear, we don’t view inflation as “dead” (see South America for examples) but certainly dormant. This is the type of scenario that must keep Fed Chair Yellen and ECB President Mario Draghi awake at night as falling prices are a much more difficult problem to solve than the reverse.

Second, we said that much of this sluggish growth was rooted in excessive leverage throughout the global economy from the sovereign level (China’s debt explosion to keep the global economy afloat in the wake of the Global Financial Crisis is a glaring example) down to the household level. In short, deleveraging must still continue, as painful a process as it may be.

While we have mostly stayed away from the small cap space in recent years, the opportunities we’ve focused on have one thing in common – a sustainable balance sheet. Proven management and high quality assets will always be of paramount importance, but without balance sheet flexibility, nothing else matters four years into this commodities bear market.

So given the challenges listed above, our takeaway last year was that we were near a bottom and the relevant question to be asking wasn’t “Have we bottomed?” but it was “Since we’ve bottomed, now what?” Just as asset prices can overshoot in bull markets, they can overshoot to the downside in bear markets. AS you can see, we were premature and various assets continued to remain under pressure over the last year (Ed note: Data in USD where applicable):

Source: Bloomberg

A look at the Reuters CRB index shows what I call a “round tripper”. The index value today is roughly where it was in December of 2002 when the commodity super cycle was just getting underway.

Source: Bloomberg

Given that, one may assume that this now is the true “bottom” however we would disagree. The amount of leverage and excess capacity in the global economy didn’t exist to the same extent that it does today and are the real impediments to a new overall commodity cycle. It’s important to remember that all commodities aren’t created equal and there are bullish opportunities (such as lithium) despite the general pervasive sense of uncertainty.

Another point to consider over the past year has been the performance of the US Dollar – up around 12% year-to-date, though it has seemingly plateaued. We think this strength is more due to weakness in other developed economies and emerging markets and the general directionless trend speaks to the muddled message coming from the Federal Reserve about the timing of a short term interest rate increase.

Source: Bloomberg

Looking at the USD performance over the past five years says volumes about where the “flight to safety” is today and also offers a good reminder of a headwind for commodities.

Source: Bloomberg

Arguably, though, the biggest story over the past year has been the collapse – not the general soft downward momentum – but the collapse in the price of oil.

Source: Bloomberg

This is what happens when politics, economics, and technology converge. While oil supply has only slightly increased on a relative basis (2% by most estimates), the oil price has collapsed by almost 42% in USD terms. We’ll examine this in more detail shortly.

So given these macro headwinds including sluggish growth, slower industrial production, falling bond yields, and policy uncertainty, maybe former US Treasury Secretary was right when he recently popularized the theory of Secular Stagnation.

This is controversial to be sure but he states:

"The problem of secular stagnation — the inability of the industrial world to grow at satisfactory rates even with very loose monetary policies — is growing worse in the wake of problems in most big emerging markets, starting with China.…

If a recession were to occur, monetary policymakers lack the tools to respond….

There is essentially no room left for easing in the industrial world." – Larry Summers in the FT

His argument really revolves around the ability to policy makers to pull monetary policy levers such as interest rate increases or decreases to maximize employment and maintain price stability. Once rates go to zero, or the zero lower bound, rate cuts lose their effectiveness and other options must be considered. With rates near zero in the United States for over 80 months and almost 3 trillion Euros worth of debt with a negative yield, we would argue that one must take Mr. Summers’ views seriously.

Looking Forward

So that’s a brief look back, but what about 2016? We’ve always been loath to make forecasts or predictions as we’ve found the “experts” to be generally off base. However, in the interest of generating some debate and discussion today, here are some of the individuals that we think hold the answers to a few questions we’ll ponder together. These individuals should need no introduction:

While you may laugh at the inclusion of Mr. Trump amongst these other individuals, his popularity with the US voter is a real surprise to everyone and we think speaks to the typical voter’s view of “establishment” politicians. In one year, we’ll know if we should be addressing him as Mr. President or not.

The one question we spend the most time fielding and debating is “What’s happening in China?” Unfortunately there are no easy answers here and we would be the first to admit that nobody knows for sure.

The attempt by Chinese officials to create a “wealth effect” by encouraging investment in their domestic equity markets failed spectacularly and has effectively frozen the ability to sell or function properly.

Source: Bloomberg

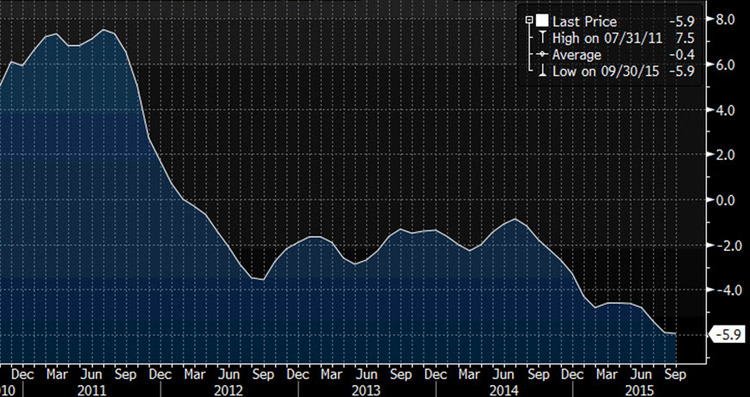

The idea was that as paper asset values increased (in this case stocks), the typical Chinese shareholder would be more inclined to spend. As consumption as a percentage of GDP increased, this would allow for the beginnings of a shift away from export and investment-led growth. The collapse of the equity bubble in China has sent policy makers effectively “back to the drawing board”. Making matters more confusing, this shift is happening against a backdrop of Chinese manufacturers continuing to export deflation as we see here with the Chinese Producer Price Index (PPI) below zero for over 40 months.

Source: Bloomberg

Lower input prices inside China ultimately find their way into global trade flows and reinforce, we believe, the risks of a debt deflation spiral going forward.

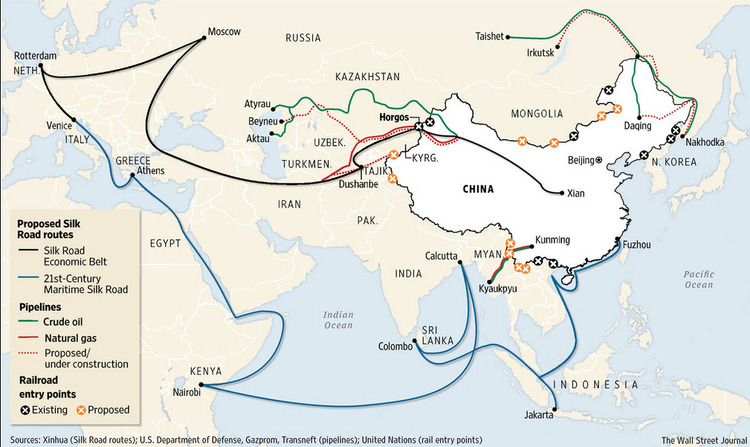

On a more positive note, China continues to attempt to wield soft power with the creation of the Asian Infrastructure Investment Bank (AIIB) and also its commitment to rebuild the Silk Road through its “One Belt, One Road” policy.

Source: WSJ

Though this may be seen as China “doubling down” on infrastructure-led growth, we view it as a longer-term positive for commodities as more infrastructure means more opportunities for trade and increasing quality of life in this part of the world which by the way hosts two thirds of global population.

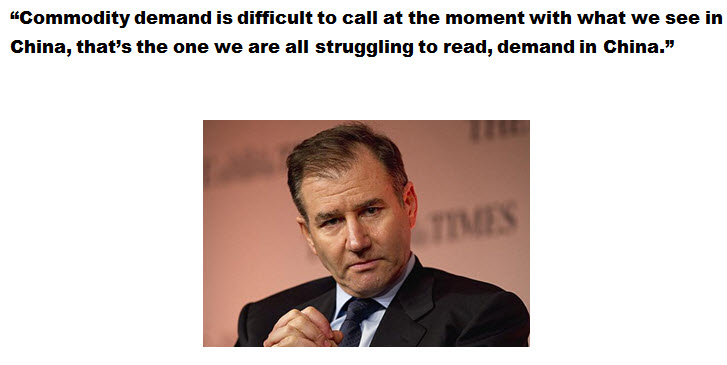

When it’s all said and done, though, as I mentioned earlier, nobody is sure about the stability in China and that remains a top risk for the commodity markets and global economy into 2016. Ivan Glasenberg, CEO of Glencore (GLEN:LON), appears to agree:

There is much more to be said here, but balancing China´s debt dynamics with the imperative for new sources of growth will likely remain the biggest issue hanging over the commodity markets for some time.

Speaking of Mr. Glasenberg, another question we’ve received recently is whether or not GLEN is “another Lehman Brothers”. Out take is that it is not when you look at relative debt levels and other metrics, but GLEN’s fortunes are certainly tied to the future direction of commodity prices. The equity has been under pressure all year, despite company officials calling the business “robust”.

Source: Bloomberg 31/10/15

The bigger issue is of course the company’s debt load. To be sure, GLEN management has made great strides in reducing this, but the CDS market is clearly worried.

Source: Bloomberg

Spikes in CDS of this nature are rare and a sign of a nervous market for company credit. This is happening as the forward curve for copper indicates a relatively benign pricing environment going forward.

Source: Bloomberg

While we would disagree with what Mr. Market is forecasting for the copper price going forward (we think it normalizes at $3.00 per pound over the next couple years), any sustained fall in metals prices could adversely impact GLEN’s credit rating, making a large debt burden only more onerous. A better place to focus may be how exposed banks are to GLEN at this point. GLEN is not another Lehman Brothers, but that doesn’t mean that commodity volatility won’t have repercussions for lenders.

Two final questions for discussion….

Are Central Banks trapped? This question should likely be considered on a one-by-one basis as prospects for a given economy and the ability of its Central Bank to manage growth vary widely.

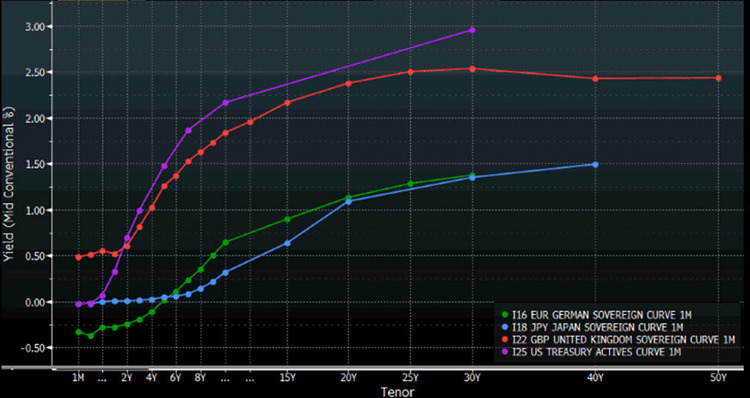

Source: Bloomberg

Note the sovereign yield curves above. Low yields in Japan have been a constant story for years, but German yields are now negative out five years on the yield curve! Even yields in the two “healthiest” developed markets – the US and UK - are sporting historically low yields. I ask you again, does this look like a market forecasting inflation? Not for now. How quickly (and if) this changes will be a key factor to watch in 2016.

A final question I offer concerns OPEC and oil. Specifically, “Can OPEC be fixed?”

Source: Bloomberg

Unfortunately, time doesn’t permit us the ability to answer this question, but the game of chicken that OPEC, led by Saudi Arabia, and the US shale industry are playing is a key to watch. Our view is that US shale has become the new “swing producer” and this is something that OPEC misjudged. True, the enormous debts taken on by shale producers likely mean more layoffs and blow ups are to come, but the excess supply and muted demand on world markets spell much more trouble for OPEC.

The data here show what oil price OPEC members (in blue) and non-OPEC (in red) need to stay out of a fiscal deficit. This is NOT the price needed to make money on a barrel of oil. Many believe that the new normal oil price will be $65 for the next couple years. If this is true (and we think it’s likely), the potential for social instability and geopolitical fireworks will only increase.

Conclusion

I know we’ve covered a great deal in a short period of time today and so I’ll end with a few “triggers” or events we’re paying attention to into 2016. These include any increase in labor productivity, the Chinese RMB gaining acceptance into the IMF’s Special Drawing Rights basket, the Bank of England’s December 1 release of bank stress tests and commodity exposure, debt deflation dynamics, and events in and around Saudi Arabia. How these events unfold in 2016 and beyond, coupled with answers to the questions posed today, will make for interesting times going forward. I hope to be able to discuss them with you both now and going forward - with or without a President Trump.

Thank you all for your time and attention today.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

The Disruptive Discoveries Journal is a free weekly newsletter we write focused uncovering and interpreting both the opportunities and challenges in the natural resources, nanotech, and clean tech sectors resulting from the belief mentioned above.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at the Disruptive Discoveries Journal make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note. I own no shares in any companies mentioned in this note and have no business relationship with any companies mentioned.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. For a more detailed disclaimer, please click here.