Full size / Ashram Project Manager Darren Smith (left), and Qualified Person Eric Larochelle (right), at the Solvay/Rhodia REE separation facility in La Rochelle (France) in 2014.

Disseminated on behalf of Commerce Resources Corp. and Zimtu Capital Corp.

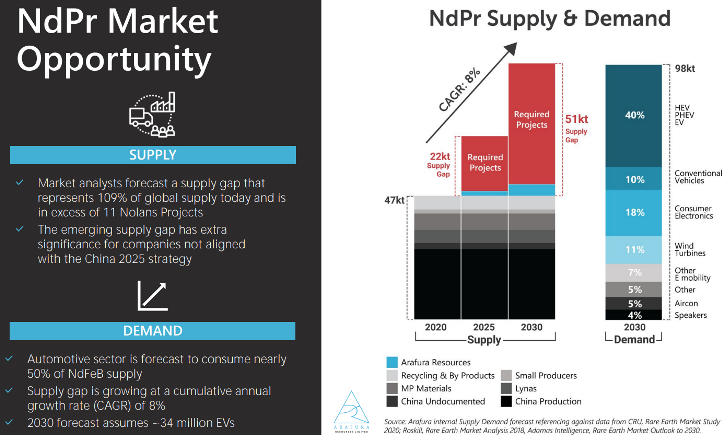

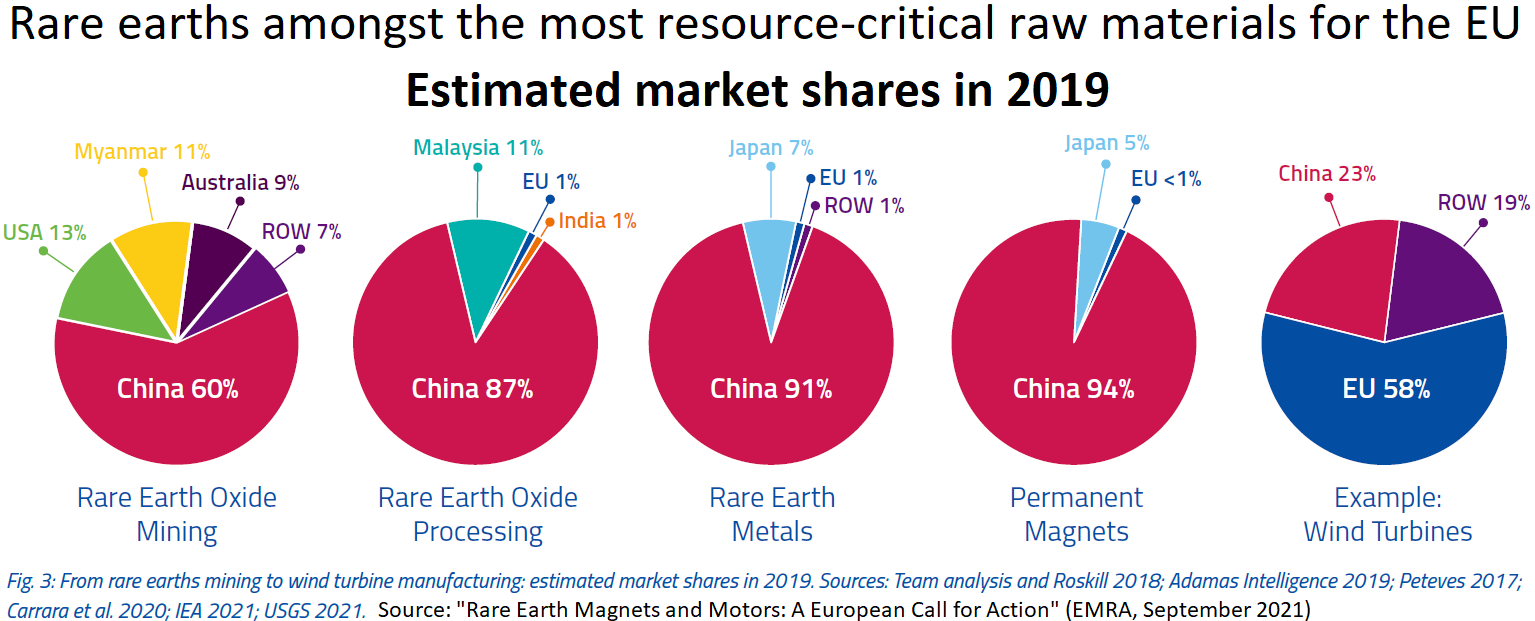

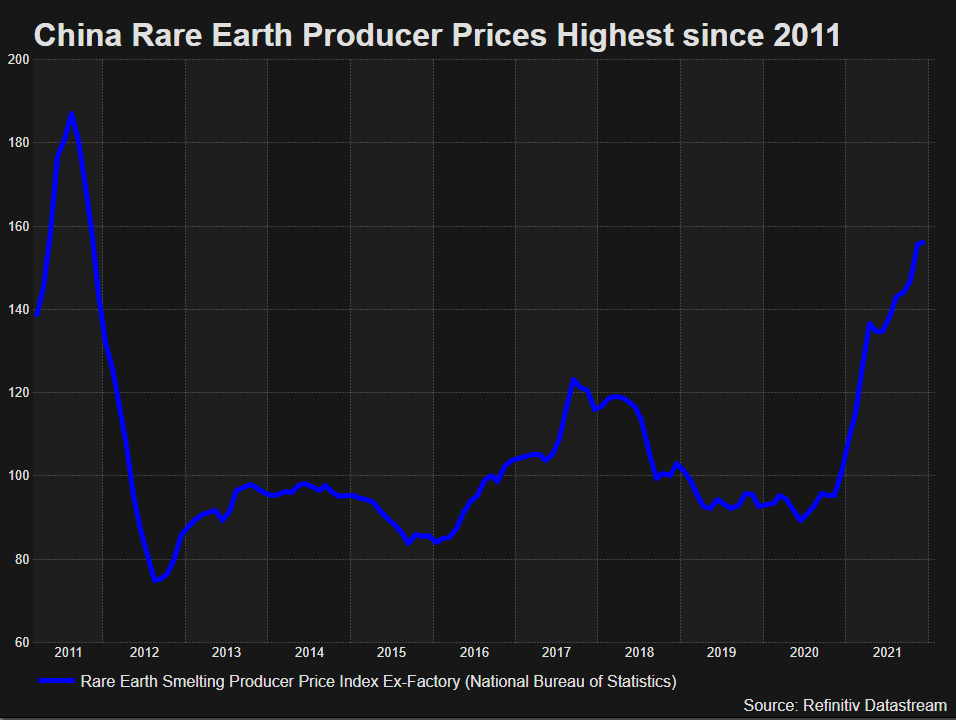

Rare Earth Elements (REE) prices are sky-rocketing, reaching levels last seen during the 2011-boom. Back then, it became obvious to the Western world that the Chinese dominance in the REE sector needs to be broken to ensure a reliable source for the future. Only now are governments in the US, EU and Australia starting to act and providing funding for REE projects to accelerate new sources coming online in the next years, when a dramatically widening supply shortfall is anticipated.

With its Ashram REE & Fluorspar Deposit in Quebec, Commerce Resources Corp. owns one of the world‘s largest REE resources with one of the highest distributions on the rare earths needed for the production of permanent magnets in electric vehicles (EVs) and wind turbines: NdPr (neodymium and praseodymium).

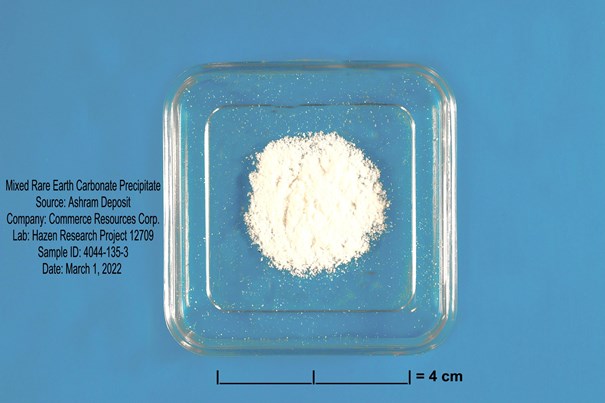

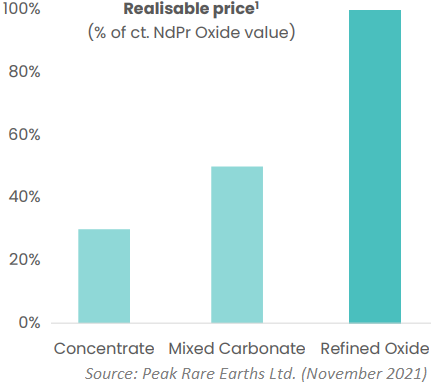

A mixed rare earth carbonate (REC) is marketable for about 50% of the value of refined/separated rare earth oxides. As part of its Final Prefeasibility Design Metallurgical Program, Commerce Resources Corp. yesterday announced the successful production of a “marketable“ mixed REC from Ashram, using a conventional recovery flowsheet.

Historically, the west dominated REE primary production and separation, with the Solvay/Rhodia facility in La Rochelle (France) being the first complete solvent extraction (SX) facility in the world. This facility with over 1,500 mixer/ settlers went into commercial operation around 50 years ago, and it was there in September 2014 where Commerce Resources first received a request for a sample. This facility was barely utilized at that time, being that Solvay/Rhodia had succumbed to the export duty imposed by China in 2005, and had set up processing operations in China to access the lower priced domestic REE feedstock in that country.

While global demand for the rare earths has better than doubled in the last decade, the only successful new REE miner in the last 17 years is Lynas Rare Earths Ltd. This point highlights how challenging it is to produce REEs economically, while at the same time, it underscores the opportunity for new potential producers. MP Materials Corp. and Energy Fuels Inc. are currently very active in developing the ability to process downstream to separated oxides, which at this time does not exist in North America.

The expectation is that there will be considerably greater domestic demand for new supplies of REE feedstock in the next few years, as these facilities are developed. The US government recently awarded $35 million USD to fund MP Materials‘ plans for the construction of a commercial-scale HREE (Heavy Rare Earth Elements) separation facility for its Mountain Pass REE Mine in California.

Excerpts from Commerce Resources‘ news-release yesterday:

Commerce Resources Produces Marketable Mixed REC Sample as Part of its Final Prefeasibility Design Metallurgical Program, Ashram Deposit, Quebec

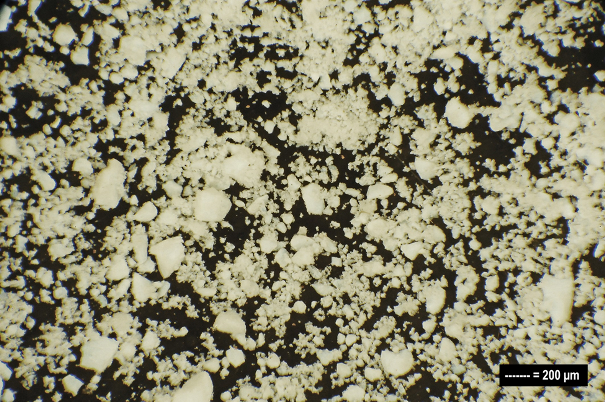

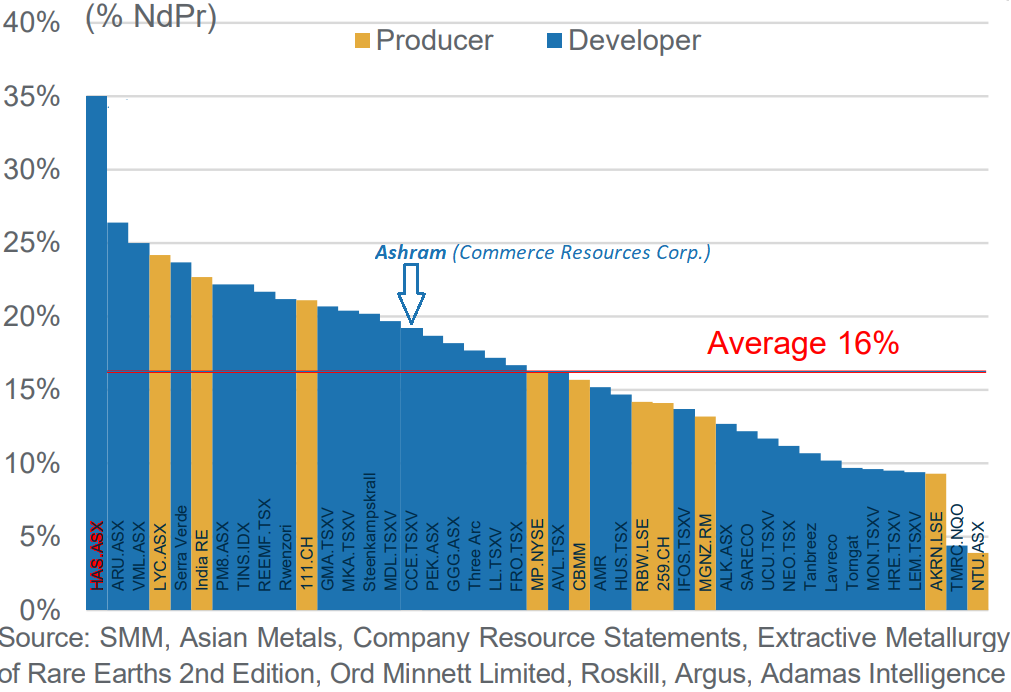

March 23, 2022 / Commerce Resources Corp. (TSXV:CCE)(FSE:D7H0)(OTCQX:CMRZF) (the “Company“ or “Commerce“) is pleased to announce that it has produced a sample of mixed rare earth carbonate (“mixed REC“) that meets typical rare earth element (“REE“) market specifications. The mixed REC sample also demonstrated a strong and consistent recovery of neodymium (Nd) and praseodymium (Pr) throughout the flowsheet, resulting in a final NdPr oxide distribution - i.e. % of Nd+Pr oxide of the total rare earth oxide (“REO“) - of 21.6%, which is significantly higher than several major global producers. This initial mixed REC sample is the last step ahead of final downstream scale-up to produce ~2.5 kg of on-spec mixed REC to satisfy several requests by third party processors. The Company expects to have its initial sample volumes ready for third party evaluation over the next few weeks.

Company President, Chris Grove comments, “The Company has achieved a key milestone in producing a marketable mixed REC product, and moreover, one with an extremely attractive NdPr distribution, which is reflective of the deposit. The flowsheet has been significantly advanced and derisked through the process of producing this mixed REC and I look forward to the delivery of these next samples to the major global processors that have requested it.“

Full size / Figure 1: Initial sample of marketable mixed rare earth carbonate produced from the Ashram Deposit. (See also below photo, both courtesy of Hazen Research Inc., Colorado)

The mixed REC sample (Figure 1) was produced from the Ashram Rare Earth and Fluorspar Deposit using the conventional recovery flowsheet developed at Hazen Research in Colorado, USA, which results in high grade monazite concentrate exceeding 40% rare earth oxide (REO). The monazite concentrate was processed through a sulphuric acid pot digestion, to ‘crack‘ the monazite, which was then followed by a water leach to liberate the individual REEs into solution at high recovery (see news release dated September 9th, 2021). The thorium was then selectively removed using solvent extraction and the REEs subsequently isolated and precipitated as a mixed rare earth carbonate concentrate, meeting typical market specifications.

In the rare earth industry, a mixed REC concentrate is typically viewed as the initial marketable product in the rare earth element value chain. A mixed REC is readily saleable as it is the most common feedstock to REE solvent extraction facilities globally, which separate each individual REE and allow for them to be individually refined into marketable products and disseminated throughout downstream value chains.

In addition to targeting the production of a mixed REC for the initial years of production at Ashram, the Company is currently evaluating moving downstream early in the mine-life through to partial separations, which will be reflected in the Prefeasibility Study (PFS). A partial separation will allow for a marketable NdPr oxide product to be produced, in addition to a Ce-La product and a mixed Sm-Eu-Gd + heavy REE product, thereby unlocking additional value while not adding significant technical risk and capital expenditures to the flowsheet by pursuing full separation of all 15 REOs at initial production.

NI 43-101 Disclosure

Darren L. Smith, M.Sc., P.Geo., Dahrouge Geological Consulting Ltd., a Permit holder with the Ordre des Géologues du Québec and ‘Qualified Person‘ as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects, supervised the preparation of the technical information in this news release

Full size / In December 2020, Ord Minnett Research published above figure showing that the average NdPr distribution among select REE development and producing companies was 16% and that, back then, Commerce Resources was slightly below 20%. Yesterday’s news from Commerce Resources showed a NdPr distribution of 21.6%, making Ashram one of the world’s top REE deposits in terms of high NdPr content (35% higher than the 16%-average). NdPr is the key ingredient in permanent magnets.

Rare Earths Getting Rare

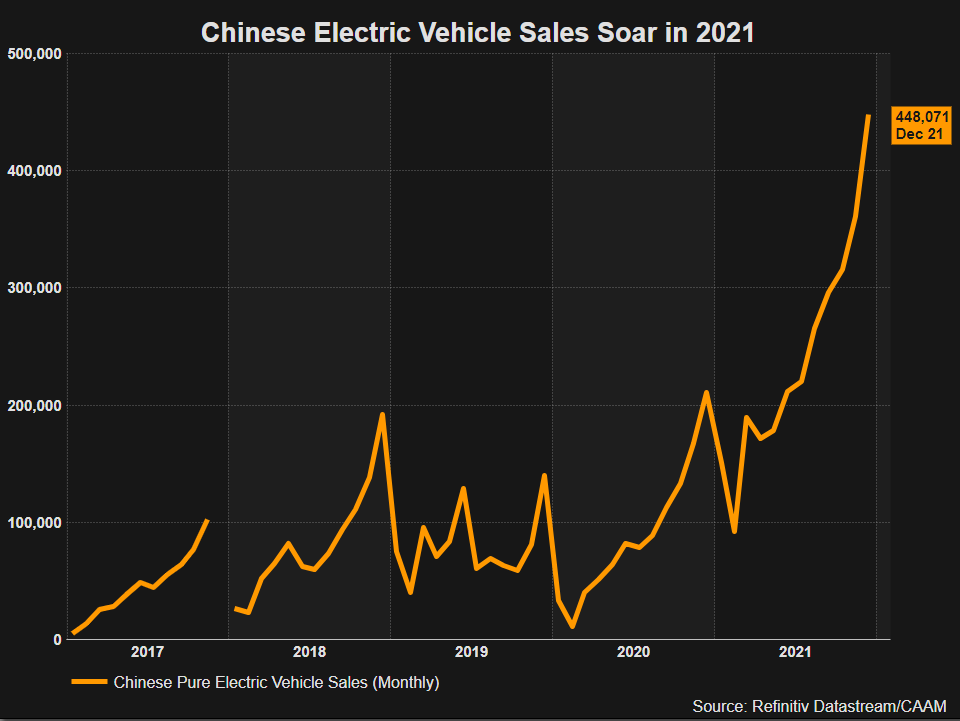

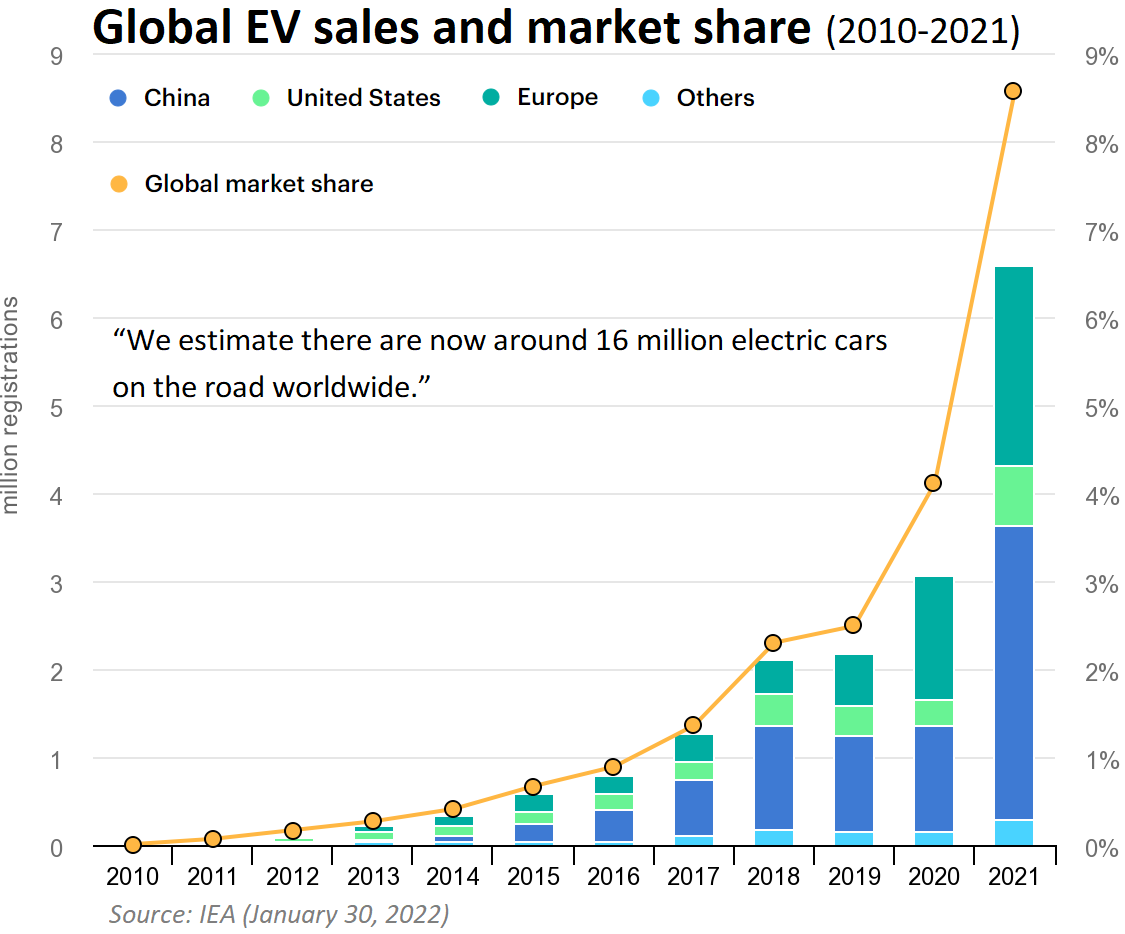

In 2012, about 130,000 EVs were sold worldwide. Today, that many are sold in a single week. Growth has been particularly impressive over the last 3 years and considering recent record-high gas prices at the pump, global EV adoption is poised to accelerate even faster than analysts have forecasted prior to the conflict in the Ukraine.

However, if supply for rare earths can‘t keep up with demand over the next years, the recent semiconductor shortage in the automotive sector has shown how many billions of dollars in lost revenue need to be taken into account again, hampering the EV adoption on a global scale.

Full size / “We estimate there are now around 16 million electric cars on the road worldwide. In absolute terms, the largest electric car market in Europe in 2021 was Germany, where more than one in three new cars sold in November and December was electric.” (Source: IEA, January 2022)

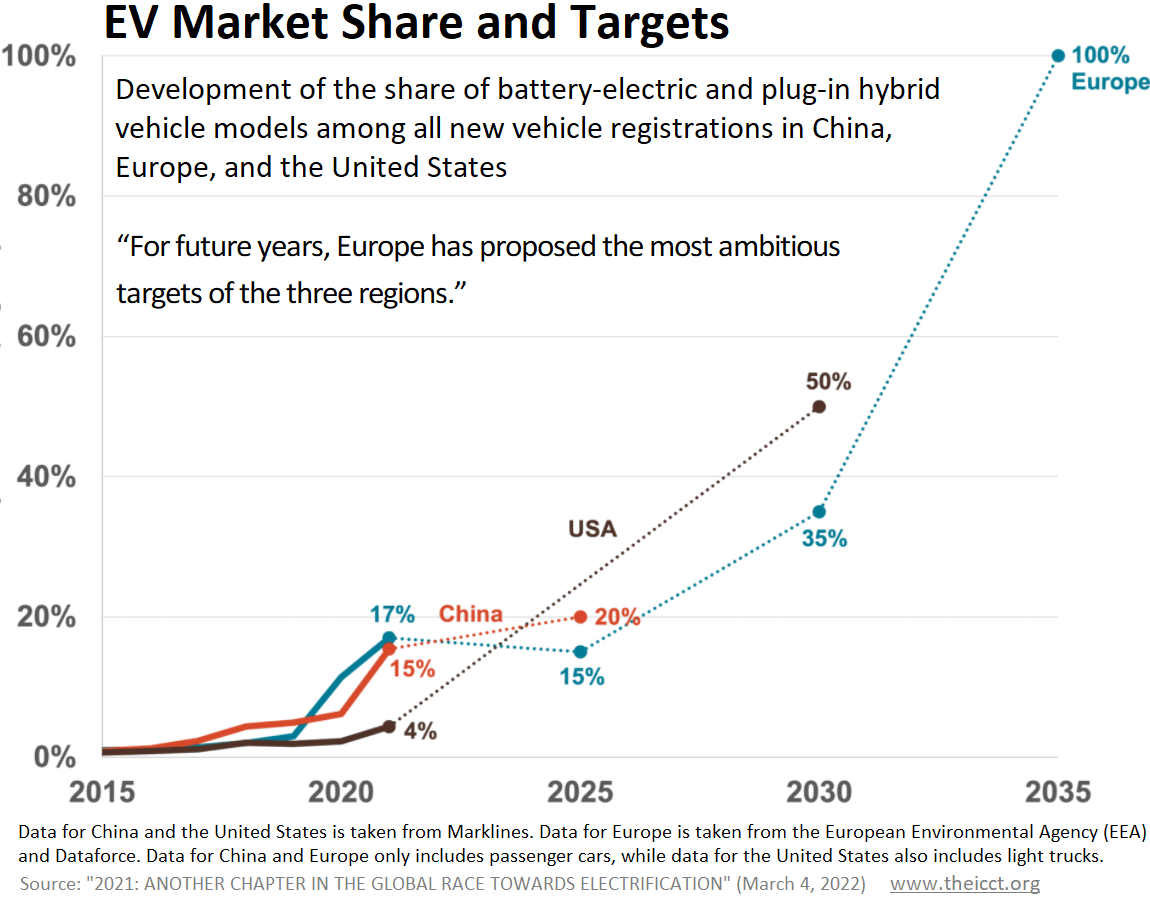

“No doubt, the global race towards electrification continues. And the speed is accelerating, quickly making previous targets seem outdated, particularly in Europe. In upcoming months, it will be up to the European Parliament and the EU Member States to take the next step by confirming, and possibly further tightening, the 2035 phase-out target for combustion engine vehicles, as suggested by the European Commission, as well as adjusting the 2025 and 2030 interim targets so that they are more in line with current market trends and the longer-term trajectory. In China and the United States policymakers will not hold still and are expected to closely monitor the political decisions in Europe while updating their own electric vehicles’ targets.” (Source: ICCT, March 2022)

Full size / “For future years, Europe has proposed the most ambitious targets of the three regions. In terms of absolute sales, China clearly remains in the lead, with more than 3 million electric cars newly registered in 2021, compared to 1.9 million in Europe." (Source: ICCT, March 2022)

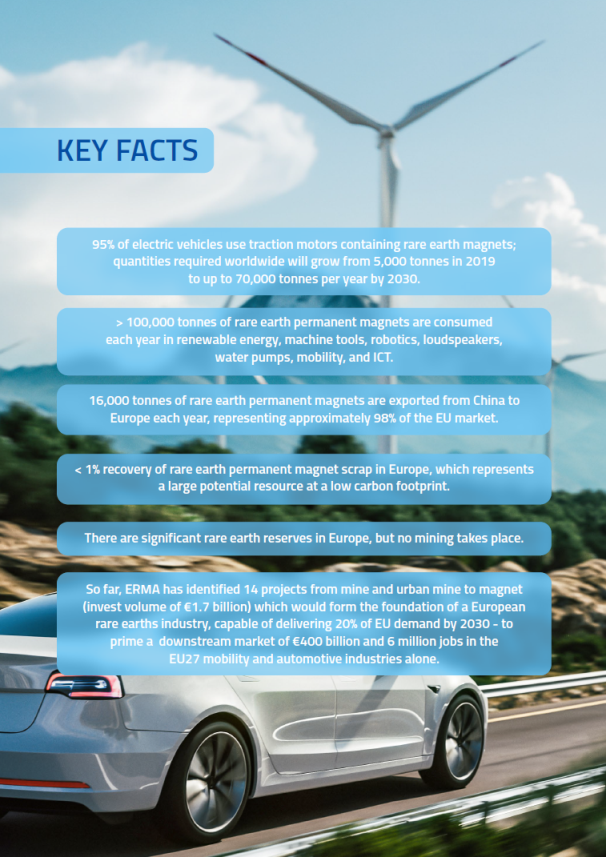

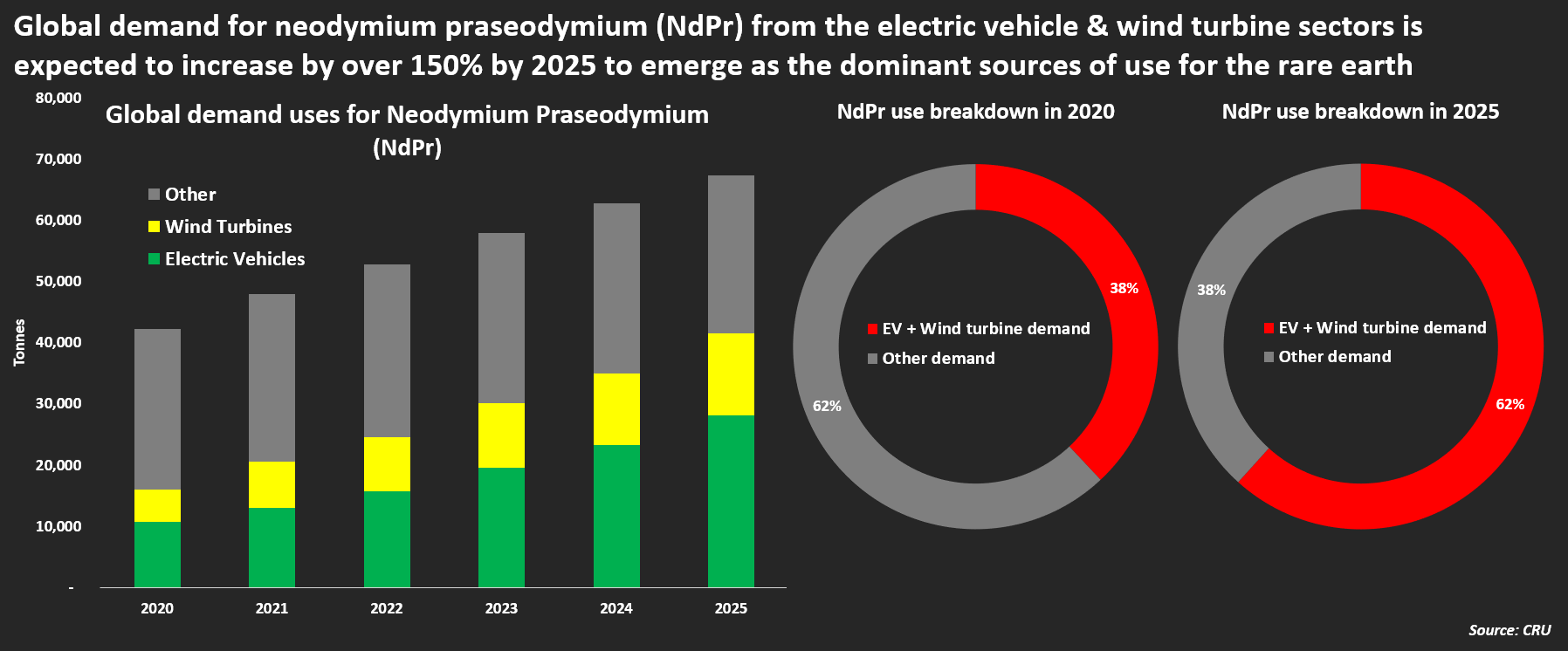

A single EV requires around 1 kg of rare earths for its motor magnets, representing just 0.05% of the car‘s total cost. These high-performance magnets are a small but critical part of an EV as it can‘t run without it! Global EV sales more than doubled to 6.6 million in 2021 (~9% of global car market). To produce 1 million EVs, ~600,000 t NdPr oxide are required.

The urgency for non-Chinese EV manufacturers to secure supply of rare earths has never been higher. Over the last years, governments around the world were not shy of setting ambitious e-mobility targets. Only now have some governments started to act and provide funding to REE development companies in an effort to speed up new supply.

According to REIA (December 2021): “The European Commission targets 30 million zero-emission vehicles by 2030 and aims for 60 GW of offshore wind by 2030 and 300 GW by 2050 as it seeks to steer countries away from fossil fuel-based energy and transport. On average, an offshore turbine requires up to 232 kg of Neodymium-Praseodymium per megawatt (NdPr/MW), which means that by 2030, the EU excluding the UK would require about 13 thousand tonnes of NdPr, and by 2050, 69.6 thousand tonnes only for wind turbines.”

Full size / CRU forecasts NdPr demand from EVs and wind turbines at 41,575 t or 62% of the total in 2025, from 20,544 t or 42% of the total in 2021. (Source; June 2021)

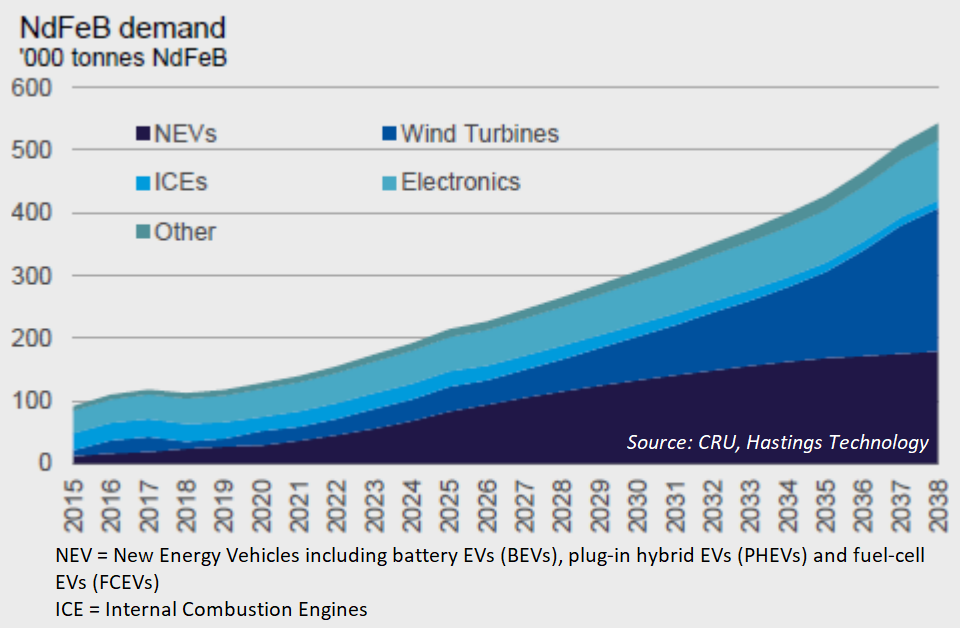

Full size / With a CAGR (Compound Annual Growth Rate) of 8.3%, global demand for NdFeB (neodymium-iron-boron) is forcasted to increase 3.9-fold between 2020 and 2038. Primary drivers are global roll-out of EVs (Electric Vehicles) and deployment of wind turbine power. (Source; November 2021)

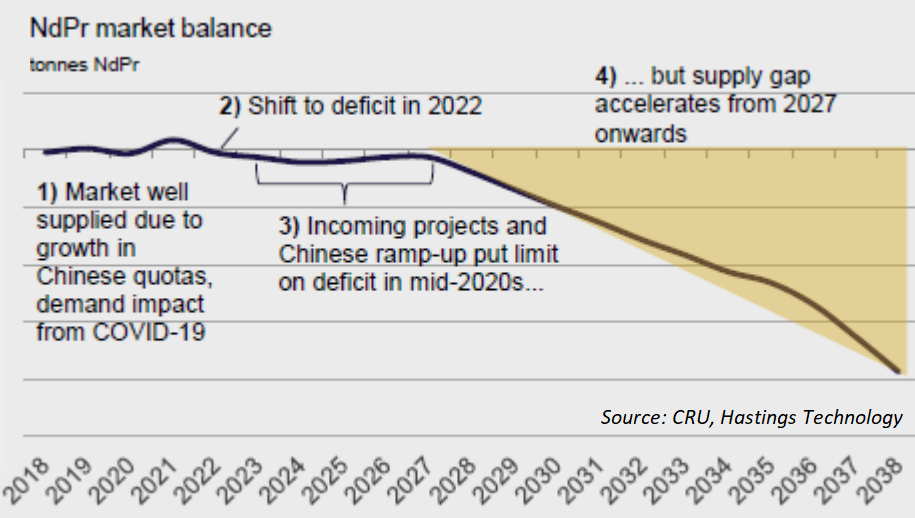

Full size / A substantial NdPr (neodymium and praseodymium) supply deficit is expected to emerge from 2027 onwards if no substantial investments into new mining projects are made now. (Source; November 2021)

According to “Rare Earth Permanent Magnets” (US Department of Energy, February 2022): “Due to the significance of the rare earth magnet supply chain, efforts have been made by various government agencies to support the development of a more resilient supply chain and encourage additional domestic production. Domestic rare earth mining has increased in recent years, and new domestic separation of rare earth concentrated into individual rare earths is expected in the near future. Potential new domestic metal refining and magnet production are also being planned, though this new production is a little farther away. While these developments are promising, they may not be sufficient to eliminate vulnerabilities and build a resilient supply chain, especially given expected growth in demand.”

“Scarce supply of raw materials for electric cars could slow the transition from fossil-fuel burning vehicles to electric ones, Mercedes-Benz (DAIGn.DE) Chief Executive Ola Kaellenius said in an interview with German paper Die Zeit on Wednesday. “The industrialization of mines and refinery capacities may not progress as quickly as demand increases. Should that happen, it would only delay e-mobility, but not prevent it,” Kaellenius said.” (Reuters, February 2022)

According to “Energy transition metals poised for uneven, explosive run higher” (Reuters, June 2021): “Buoyed by powerful demand expectations as the world moves away from reliance on fossil fuels, prices of many industrial metals rocketed, but future price rises are likely to be limited to a select few energy transition ingredients... “Energy transition metals will take off big time, but not all at the same time,” Wood Mackenzie analyst Julian Kettle said... Magnets made with neodymium and praseodymium (NdPr) are used in wind turbine generators and electric vehicle motors. Electric vehicles made without rare earths are less efficient as the battery pack needs to be about 30% larger to cover the same distance, analysts say. CRU analyst Daan de Jonge sees the energy transition lifting demand and prices for NdPr over coming years to levels that incentivise new projects...”

According to “Rare earths markets to remain in deficit until 2030” (MiningNews, January 2022): “Canaccord is now forecasting a market deficit for rare earth magnets until 2030, compared to previous forecasts for balanced conditions. This revision is driven by an increase in electric vehicle sales... Canaccord has increased its forecast for electric vehicle sales in coming years, with sales now forecast to increase by 18% per year between 2021 and 2024. The investment bank expects electric vehicles to comprise 45% of the market by 2030... Demand from magnets will also be boosted by the construction of wind turbines, Canaccord said."

Who‘s Next in the West?

On February 22, US President Joe Biden announced $35 million USD in funding awards to MP Materials Corp. (NYSE: MP; market capitalization: $8.9 billion USD) to support the construction of a commercial-scale processing facility for HREE (Heavy Rare Earth Elements) at the Mountain Pass REE Mine in California. In a separate contract awarded in December 2020, the US Department of Defense committed $9.6 million USD to MP Materials’ Stage II optimization, a project underway to restore LREE (Light Rare Earth Elements) processing capabilities to Mountain Pass. In late 2021, MP Materials estimated its market share at 15% of global REO demand. With a record 2021-production of 42,413 t REO (in concentrate), the subsequent separation of HREE and LREE took place in China. Backed by the recent federal funding, MP Materials is making accelerated progress on its mission to restore the full rare earth supply chain to the US.

Full size / “The Lynas Corporation [ASX: LYC; market capitalization: $9.2 billion AUD], based in Australia, manages the only complete supply chain outside of China. However, with its only processing plant in Malaysia, a critical component is subject to somewhat unpredictable foreign governance. To “diversify [its] industrial footprint” Lynas is currently constructing a second processing plant in Australia and has received more than $30 million from the U.S. DoD to support processing plant construction in Texas.” (Source; January 2022)

On March 11, the European Raw Materials Alliance (ERMA) announced to support Mkango Resources Ltd. (TSX.V: MKA; market capitalization: $90 million) with securing financing for the development of a rare earth separation plant to be located in PuÅ‚awy, Poland: “This plant will be supplied with rare earth carbonate originating from Mkango’s Songwe Hill primary deposit of rare earth elements in Malawi, Africa. The plant will also be able to process other materials supplied by third-party providers thus acting as a future European Hub for rare earth elements separation.“ At PuÅ‚awy, a phase-1 production of 2,000 t NdPr oxide annually is expected. The Songwe Hill REE Deposit hosts 21 million t @ 1.41% REO (Measured & Indicated; ~95% of which at a depth of less than 160 m below surface of the hill) and 27.5 million t @ 1.33% REO (Inferred) at a Base Case 1% REO cut-off grade (2019).

On March 16, Australian Prime Minister Scott Morrison announced $243 million AUD in fresh grants for Australian projects that will source and refine critical minerals, including rare-earth metals – key manufacturing ingredients in the renewable energy economy. Projects funded by the Federal Government’s Modern Manufacturing Initiative (MMI) include $30 million AUD to Arafura Resources Ltd. (ASX: ARU; market capitalization: $457 million AUD) and the construction of a rare earth separation plant for the Nolans REE Deposit (56 million t @ 2.6% REO in Measured & Indicated + Inferred). With its $91 million AUD separation plant, Arafura plans to produce 2 final rare earth products for export: 4,440 t NdPr oxide and 470 t mixed middle-heavy rare earth (SEG/HREE) oxide annually. Arafura notes that “analysts forecast a supply gap that represents 109% of global supply today and is in excess of 11 Nolans Projects”.

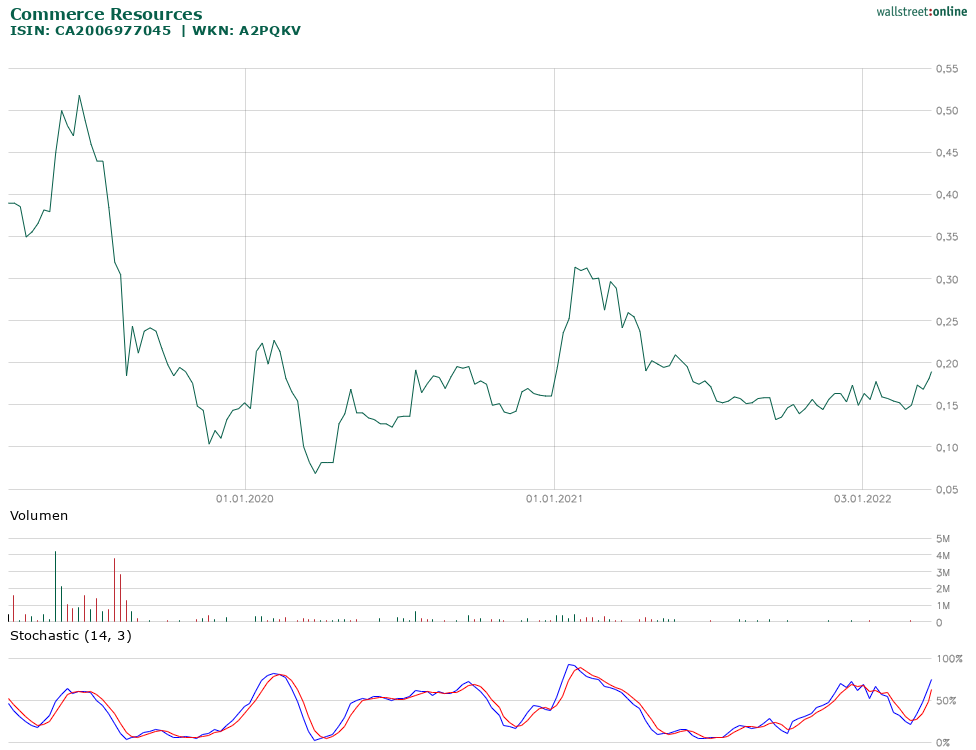

In support of an updated resource estimate to be completed as part of the ongoing Prefeasibility Study, Commerce Resources Corp. (TSX.V: CCE; market capitalization: $25 million) announced recent infill-drilling success at its Ashram REE & Fluorspar Deposit in Quebec (302 m @ 2.19% REO starting from 4.7 m; 300.1 m @ 1.83% REO starting from 1.9 m; 225.4 m @ 1.82% REO starting from 1.6 m; 223.2 m @ 1.79% REO starting from 0.8 m) to upgrade some of the large Inferred resource (219.8 million t @ 1.88% REO) to Measured & Indicated. Ashram’s open-pit-restrained resources represent one of the world’s largest REE and fluorspar deposits and its 2012-PEA envisioned a production of ~16,850 t REO annually, which would be ~40% of the quantity MP Materials exported to China last year, generating $135 million USD in net-income.

On February 14, the leading Chinese rare earth company Shenghe Resources Holding Co Ltd. agreed to acquire (for $39 million AUD) Appian Pinnacle Holdco Ltd.‘s 19.9% minority stake in Peak Rare Earths Ltd. (ASX: PEK; market capitalization: $156 million AUD): “Shenghe is a large Chinese rare earth group with operations spanning mining and beneficiation, refining and separation, as well as alloy and metals production. Its international interests include a ~8% holding in MP Materials Corp., a 90% holding in Vietnam Rare Earth Co. Ltd., and a 9% holding in Greenland Minerals Ltd. Shenghe is listed on the Shanghai Stock Exchange and has a market capitalization of ~$4.9 billion USD.“ Peak‘s Ngualla REE Deposit in Tanzania hosts resources of 214 million t @ 2.15% REO and reserves of 18.5 million t @ 4.8% REO with plans to produce 37,200 t REO annually in concentrate at a grade of 45% TREO. For comparison: Commerce Resources demonstrated its ability to produce a high-grade (>45% REO) concentrate at high recoveries (>75%).

On February 2, the Australian government agreed to provide a $140 million AUD project financing loan to Hastings Technology Metals Ltd. (ASX: HAS; market capitalization: $469 million AUD). Its Yangibana REE Deposit in Australia hosts 16.7 million t @ 0.95% REO in reserves (Proven & Probable) and 27.42 million t @ 0.97% REO in resources (Measured & Indicated + Inferred) with plans to produce ~15,000 t mixed carbonate annually by 2024, having signed MOU offtake agreements with Qiandong Rare Earths, China Rare Earth Holdings, and Baotou Sky Rock Rare Earth.

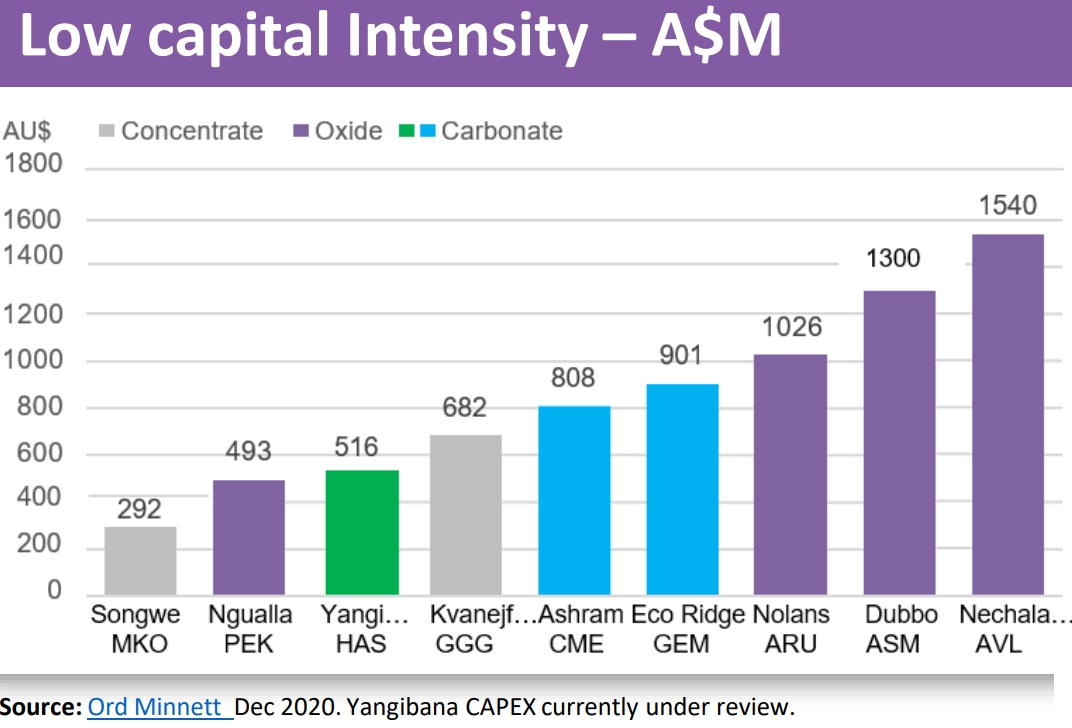

Full size / For CAPEX of $516 million AUD, Hastings plans to build a hydromet plant in Autralia for the production of a mixed carbonate product, whereas Commerce Resources’ 2012-PEA was $763 million CAD ($808 million AUD) in CAPEX for a mixed carbonate. Global CAPEX average of greenfield development projects for mixed carbonate: $850 million AUD. Global average for vertically integrated (separate oxide) production: $1 billion AUD (Source; December 2022)

In December 2021, China merged 3 state-owned REE companies to increase pricing power and efficiency, establishing China Rare Earth Group Co. Ltd., the largest move of its kind in the world. Based on 2021 data, the new group will have 52,719 t of mining quota (31% of China’s total) and 47,129 t of smelting quota (29% of China‘s total). The new megafirm will account for about 62% of heavy rare earth supplies nationally and have enhanced pricing power of key rare earths. China believes the minerals have been trading for “cabbage prices”. Under the new merger, “prices are expected to be rationalized“.

Canada‘s first rare earth processing facility looking for mixed REC feed stock: In August 2021, the Saskatchewan Research Council (SRC) provided an update that the construction of the first stage of its Rare Earth Processing Facility in Saskatoon (Saskatchewan), which includes a Monazite Processing Unit (MPU) and a Solvent Extraction Unit (SXU), is underway:

“SRC is continuing to make progress with the Facility‘s design and the procurement of the highly specialized plant equipment. The MPU is expected to be operational ahead of schedule, in early 2023. The fully-integrated Facility is expected to be operational by mid-2024. In July 2021, SRC procured up to 800 tonnes of monazite concentrate from Indústrias Nucleares do Brasil (INB), S.A., in Brazil from their mine and processing facility. The monazite concentrate will arrive at SRC in the spring of 2022 and will be used as a feedstock for the MPU, once operational. SRC continues to source additional preconcentrated monazite globally prior to the MPU commissioning. SRC’s Facility will require 3,000 t annually of monazite concentrate on a 90 per cent basis (equivalent to 60 per cent Total Rare Earth Oxide). However, SRC would like to secure a stockpile of feed in advance of commissioning.“

The conversion of REE ore to individual REE products is done in 2 main stages: The first is the concentration of ore to mixed REC. The second is the more complex separation stage that converts mixed REC to commercial pure-grade REEs. The SRC facility will address both stages of REE processing.

In August 2020, the Government of Saskatchewan announced $31 million in funding to SRC‘s facility. Premier Scott Moe stated: “Saskatchewan’s new Rare Earth Processing Facility will be a catalyst to stimulate the resource sector in Saskatchewan and across Canada, providing the early-stage supply chain needed to generate cash-flow, investment and industrial growth of the sector. It will also help ensure the competitiveness of Saskatchewan as we focus on our economic recovery and grow our province over the next decade.”

Based in Beatrice, Nebraska, Rare Earth Salts Separations and Refining LLC, is another potential customer, having requested samples of Commerce Resources‘ mixed REC product. Backed by government funding, the company uses “a proprietary patented technology to efficiently separate the rare earth elements in a cost-effective and environmentally friendly process,“ according to its website which also states: “Rare Earth Salts is a privately held industrial and applications technology company focused on the separation and refining of all sixteen rare earth elements to high purity from various feedstocks worldwide.“

Another potential processor of a mixed REC is Energy Fuels Inc. (NYSE: UUUU; market capitalization: $1,6 billion USD), aiming to initially process 2,500 t monazite annually with its permitted White Mesa Mill in Utah, however looking for at least 15,000 t annual monazite feedstock. See more details on Energy Fuels here.

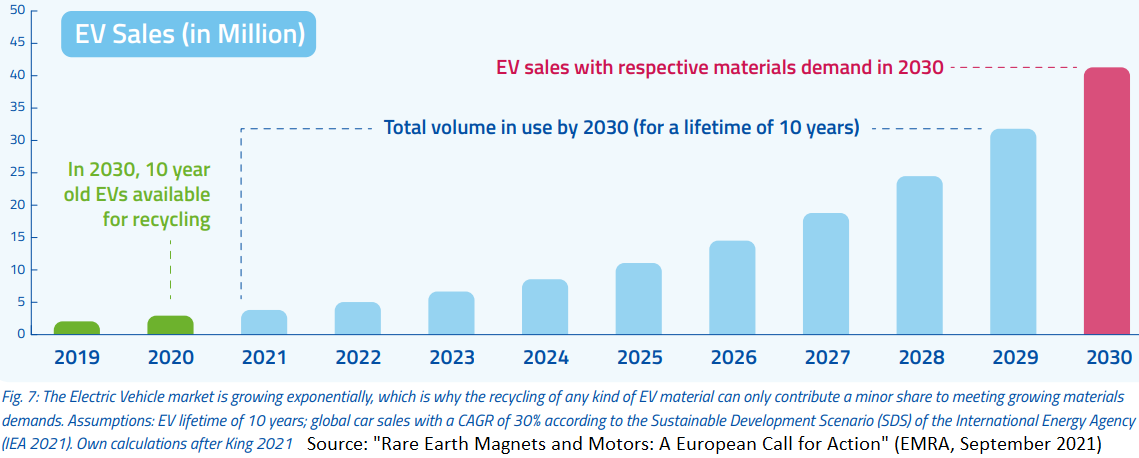

Full size / “Both primary metal mining and production as well as recycling needs to be developed to meet the materials demands of an exponentially growing rare earth magnet market: for the foreseeable future, recycling alone can only meet a minor fraction of the growing materials demands...” (Source: “Rare Earth Magnets and Motors: A European Call for Action” by EMRA in September 2021)

“The economic importance of the rare earths value chain becomes obvious by looking at the emerging electric vehicle market: over the last decade, the evolution of technology has resulted in 95% of EVs using permanent magnet motors by 2019, particularly because they provide the highest energy efficiency which translates into driving range. In 2019, about 5,000 t of rare earth permanent magnets were used in EVs worldwide. By 2030, the number may rise to between 40,000 and 70,000 t on a global level, depending on the anticipated growth scenario. A global EV market worth about € 625-1,000 billion would depend on securing access to sustainably produced rare earth magnets – a comparatively small but specialised market of about € 2-3 billion (value corresponding to magnet volume share needed in the respective EV sector). As indicated above, this pattern is reflected in other industrial ecosystems: energy efficient electric motors are also needed in fuel cell electric vehicles and domestic appliances, like energy efficient refrigerators, washing machines, and dishwashers; rare earth containing wind turbines are gaining market share, particularly in offshore wind farms due to their robustness and efficiency; all microphones and speakers of mobile devices contain rare earth magnets due to the need for miniaturisation.” (Source: “Rare Earth Magnets and Motors: A European Call for Action” by EMRA in September 2021)

“The European Commission considers rare earths to be amongst the most resource-critical raw materials: they are of highest economic importance and at the same time feature a high supply risk. They play a vital role in the industrial economy of Europe, that is, in traditional sectors as well as in emerging ones, including aerospace and defence. In 2019, about 130,000 t of rare earth permanent magnets (Nd-Fe-B) were produced worldwide which corresponds to a market volume of about €6.5 bn. 94% of these magnets were produced in China, reflecting a very high production concentration (which is, in fact, found across all rare earth value chain steps, from mining to recycling). Today, there is a 1,000 t production capacity left in Europe competing with 16,000 t of Chinese magnets imported each year. In addition, rare earth magnets are increasingly imported as part of motors and generator assemblies and products. Despite a growing market, the EU magnet production capacity is not fully utilised today and is rather serving specialised niche applications. This is due to the fact that European producers can hardly compete in terms of prices with Chinese magnet makers, because there is a lack of a level-playing-field... In fact, after decades without investment into the rare earths industry in the Western hemisphere, China has gained a monopoly in rare earths, which is very hard to compete with in a free market. There is a lack of, i) supply chain diversification, market driven competition, and resilience against supply shocks; ii) supply chain transparency and a clear definition of sustainability standards; iii) industrial capacity to implement an EU Circular Economy of rare earth materials; and iv) strategic investments aiming to benefit from a growing materials market to create economic growth and new jobs in Europe, i.e. jobs directly related to the rare earth magnet and motor value chain as well as indirect jobs secured downstream.” (Source: “Rare Earth Magnets and Motors: A European Call for Action” by EMRA in September 2021)

“The EU should strategically invest in the rare earths value chain and become world leader in the Circular Economy of rare earths. To enable this, improved intelligence in the rare earths magnets and motors value chain is required as a sound basis for decision making, that is, for political and industrial leaders, investors as well as for consumers. Many primary rare earth sources around the world have been identified and investigated over the past 10-15 years, but the results of such studies have been published in various locations and it is time consuming to try to compile key information about them on a comparable basis. Europe hosts several occurrences, some of which are currently being investigated. In particular, the quantity (resource and reserve tonnages) and quality (resource and reserve grades of individual REEs) of mineralisation, and the key technical and economic assumptions (e.g., processing recoveries, price and cost assumptions) are of critical importance when assessing primary rare earth sources.” (Source: “Rare Earth Magnets and Motors: A European Call for Action” by EMRA in September 2021)

Rare Earths Booming

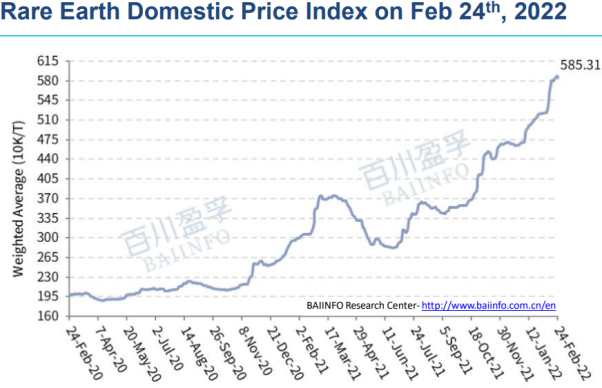

Full size / BAIINFO’s Rare Earth Industry Weighted Average (2020-2022) increased by 200%. (Source)

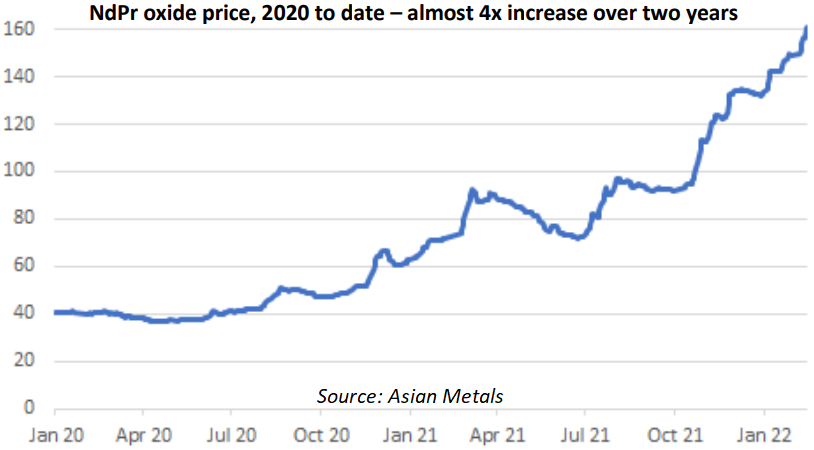

Full size / “The RE sector continues to enjoy strong NdPr prices, which continue to go from strength to strength, with the NdPr oxide price already up 20% for CY22, and having enjoyed an almost fourfold increase since January 2020. The reference price has just broken US$160/kg, an 11 year high, a level not seen since June 2011.” (Source; February 2022)

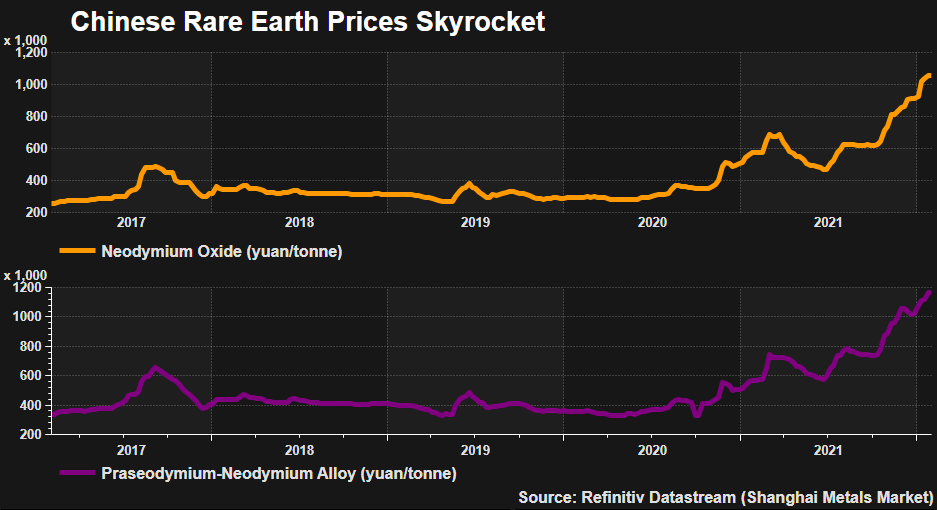

Full size / “The Chinese price of praseodymium-neodymium alloy used to make super-strong magnets used in EV motors doubled last year and has already shot up more than 10% so far in 2022 to 1.17 million yuan ($184,072) per tonne.” (Source; February 2022)

Full size / "Gary Gao at data provider Shanghai Metals Market said they expected rare earth prices to remain strong until at least 2025. “Policymakers (in China) think that the current price for REE (rare earth element) oxides is somewhat undervalued,” he told a webinar... Global sales of EVs more than doubled in 2021 to 6.6 million, more than tripling their market share from two years earlier, according to the International Energy Agency... “The situation is as tight as it has ever been... and demand gets stronger month after month,” said Ryan Castilloux of consultancy Adamas Intelligence.” (Source; February 2022)

According to Reuters (February 24, 2022): “[MP Materials Corp.] said its realized price for rare earth oxides (REO) soared 148% to $10,101 per metric tonne square in the quarter... Currently, MP lightly processes rare earths it extracts from California’s Mountain Pass mine and ships the material to China for separation into various rare earth metals because there are no U.S.-based options. The U.S. government has funded the Las Vegas-based company in part to help bring processing back to the country, where the rare earths industry had its genesis in the mid-20th Century.”

According to ERMA (March 11, 2022): “Securing critical raw materials for the European market is the main goal of the European Raw Materials Alliance (ERMA). The current issues with Europe’s dependency on oil and gas clearly show the importance of diversification of value chains across all strategic industries for the production of green energy... Neodymium and praseodymium are key components of permanent magnets used in electric vehicles, wind turbines and many electronic devices and prices for Nd / Pr oxides have risen by 85% and 135% respectively over the last 12 months... This cooperation and support with securing financing is one of the first projects resulting from ERMA’s strategic initiatives securing rare earth elements for European industry. A first action plan entitled “Rare Earth Magnets and Motors: A European Call for Action” was issued in September 2021. This report outlines current and projected European demand for Rare Earth Elements and steps which should be taken to secure their supply. The PuÅ‚awy project is addressing several critical issues highlighted in the report.”

According to Quartz Media (March 7, 2022): “Last month, a price index from the Association of Chinese Rare Earth Industry hit a historic high, breaking 430 – roughly double where it was a year ago... One kilogram of neodymium oxide, for example, now costs around 1100 yuan ($173), up from around 686 yuan ($108) last March... Analysts predict the upward trajectory will continue through the year.”

Full size / Chart / “With the increased demand for rare earths – up to a fivefold demand increase over the next 10 years – we will need all hands-on deck. Combined with the current resurgence in uranium, rare earths represent a truly immense opportunity.” (Mark Chalmers, CEO of US-based uranium and REE-carbonate producer Energy Fuels Inc. (NYSE: UUUU; market capitalization: $1.6 billion USD), in February 2022)

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 91,654,630

Canada Symbol (TSX.V): CCE

Current Price: $0.27 CAD (03/22/2022)

Market Capitalization: $25 Million CAD

Germany Symbol / WKN (Tradegate): D7H0 / A2PQKV

Current Price: €0.19 EUR (03/24/2022)

Market Capitalization: €17 Million EUR

Previous Coverage

Report #34 “All Roads Lead To Ashram, Eventually“

Report #33 “Research & Advisory Firm looks into the Ashram REE & Fluorspar Project from Commerce Resources“

Report #32 “Already Big Ashram Gets Bigger And Bigger“

Report #31 “Fluorspar: The Sweet Spot for Quebec‘s Steel and Aluminium Industries“

Report #30 “Lean and Mean: A Fighting Machine“

Report #29 “Like A Phoenix From The Ashes“

Report #28 “SENKAKU 2: Total Embargo“

Report #27 “Technological Breakthrough in the Niobium-Tantalum Space“

Report #26 “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #25 “The Good Times are Back in the Rare Earths Space“

Report #24 “Commerce Resources and Ucore Rare Metals: The Beginning of a Beautiful Friendship?“

Report #23 “Edging China out of Rare Earth Dominance via Quebec‘s Ashram Rare Earth Deposit“

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Commerce Resources Disclaimer: Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Forward Looking Statements: This news release contains forward-looking statements, which includes any information about activities, events or developments that the Company believes, expects or anticipates will or may occur in the future. Forward looking statements in this news release include that we expect to complete a prefeasibility study for the Ashram Project; that mixed REC is readily saleable; that partial separation will allow for a marketable neodymium and praseodymium oxide to be produced; that we may move downstream early in the mine-life through partial separation; that Ashram has the potential to become one of the largest fluorspar deposit and a long-term supplier to the met-spar and acid-spar markets; and that the Company is positioning to be one of the lowest cost rare earth element producers globally. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these events, activities or developments from coming to fruition include: that we may not be able to fully finance any additional exploration on the Ashram Project; that even if we are able raise capital, costs for exploration activities may increase such that we may not have sufficient funds to pay for such exploration or processing activities; the timing and content of any future work programs; geological interpretations based on drilling that may change with more detailed information; potential process methods and mineral recoveries assumptions based on limited test work and by comparison to what are considered analogous deposits that, with further test work, may not be comparable; testing of our process may not prove successful or samples derived from the Ashram Project may not yield positive results, and even if such tests are successful or initial sample results are positive, the economic and other outcomes may not be as expected; the availability of labour and equipment to undertake future exploration work and testing activities; geopolitical risks which may result in market and economic instability; and despite the current expected viability of the Ashram Project, conditions changing such that even if metals or minerals are discovered on the Ashram Project, the project may not be commercially viable; The forward-looking statements contained in this news release are made as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

Rockstone Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Commerce Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Commerce Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through their respective profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Commerce Resources Corp. and Zimtu Capital Corp., and is being paid by Zimtu Capital Corp., which company also holds a long position in Commerce Resources Corp. Note that Commerce Resources Corp. pay Zimtu Capital Corp. to provide this report and other investor awareness services.