After aluminum and copper, zinc is the mostly used nonferrous metal in the world thanks to its capacity to protect ferrous metals against corrosion/rusting. Hence, the “infrastructure metal” zinc is mainly used galvanizing/coating iron and steel products, such as vehicles, buildings, bridges, railways and other structures.

“Although many elements can be used as a substitute for zinc in chemical, electronic, and pigment applications, the demand for zinc galvanized products remains strong, especially in regions where significant infrastructure projects are being developed. The dramatic increase in the worlds production (supply) and consumption (demand) of zinc in the past 35 years reflects demand in the transportation and communications sectors for such things as automobile bodies, highway barriers, and galvanized iron structures.” (1)

If the global economic recovery progresses in the next years, demand for zinc will increase accordingly. However, even if global economics will worsen in the future, demand for zinc is set to be strong due to massive infrastructure projects in industrialized and emerging countries being executed no matter what. Additionally, natural disasters such as earthquakes or tsunamis require reconstruction activities that can have the magnitude of changing demand significantly.

The OECD estimates a yearly investment requirement for worldwide infrastructure projects in the area of 600 billion dollar for the next 20 years – only to guarantee the provision of water. Additionally, the OECD expects China to spend some 2,000 billion dollar until 2030 for infrastructure only to produce and distribute energy. And such cost-intensive infrastructure developments are not only limited to undeveloped countries. As per the OECD, the USA and Canada must invest around 1,800 billion dollar in its electricity facilities, which is almost as much as China. “The Government of India plans to invest over 1 trillion dollar over the next 5 years to meet the countrys huge infrastructure demands. Over 50% of these funds will come from the private sector.” Any development of infrastructure is highly zinc intensive.

The urban development trend especially in undeveloped countries is set to additionally escalate the demand dynamics for zinc. New markets and industries, as well as emerging countries, foremost demand buildings, structures and transportation routes, such as streets, rails, waterways and airports, besides all kinds of new facilities that, for example, provide the supply of water and electricity.

Urbanization is people increasingly leaving rural and undeveloped regions to move into cities. In cities, the per capita consumption of zinc is significantly higher than in the countryside. Calculations forecast that in 2050, some 6.5 billion people will live in cities – today it is only 3.5 billion. These 3 billion new people, or 86% more than today, represent on average 1.5 million people more per week living in cities. The enlargement of all cities in the world until 2050 is expected to equal the combined areas of Germany, France and Spain.

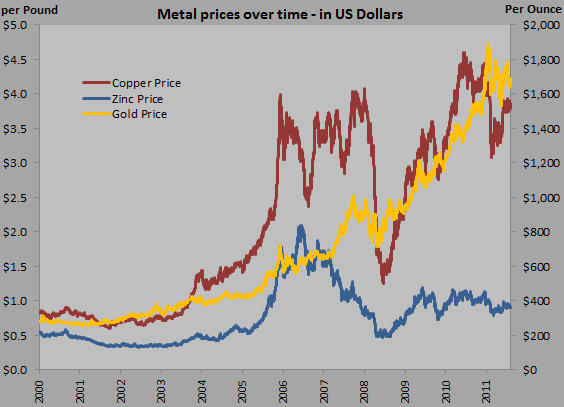

The zinc price is set to escalate over the next years not only because of sound demand dynamics on a global scale, but additionally due to a looming chronic shortage of supply. The coincidental closure of large zinc mines (e.g. Brunswick, Century, Lisheen, Skorpion) due to depletion coupled with only few new zinc mines being developed these days leads to a regressive supply. As we expect demand to remain strong over the next decades (no matter if global economics recover or not) and supply to be in a slump, we anticipate much higher zinc prices, especially when considering that zinc today sells for around the same price as in the late 1980s and early 1990s.

More than 50 countries around the world mine zinc ore, with Australia, Canada, China, Peru and the USA being the largest producers. About 80% of the worldÂ’s zinc is mined underground, while 8% is mined via open pits with the rest using a combination of both methods. (2)

The following graph shows the change in supply and demand since 2000 with estimations by Brook Hunt for 2012-2017. It is estimated that demand will grow 2-3% per year, especially in industries such as construction, automotive and transport due to zinc`s long useful life-cycle. In the years 2013-2014, demand is expected to exceed supply and a chronic deficit to arise.

Scotia Bank (Toronto, Canada; March 2012):

“Zinc may represent the next big base metal play. Zinc will shift into "deficit" (at latest by 2014) due to ongoing demand growth in the face of significant global mine depletion in mid-decade. In 2013, the closure of the Brunswick mine in Canada, Century in Australia and Vedantas Lisheen mine in Ireland will shift sentiment towards zinc, with prices rallying in anticipation of tightening supplies. In the second half of this decade, zinc demand will be boosted by a recovery in G7 construction activity, particularly in the USA.”

Brook Hunt (Wood Mackenzie; April 2012):

“Zinc has the most promising fundamental outlook among the metals… The zinc price is expected to be rangebound for the most part of this year before starting its ascent towards the end of 2012 in anticipation of a tight market. Brook Hunt expects the zinc price to average US$1.24/lb in 2014 and steadily climb thereafter, possibly challenging the previous high of US$2.08/lb that was reached in late 2006.”

Similar comments about the upcoming shortage of supply and zinc inventories being drawn down below critical levels have been made by Credit Suisse, RBC Capital Markets and Goldman Sachs.